September 2, 2020

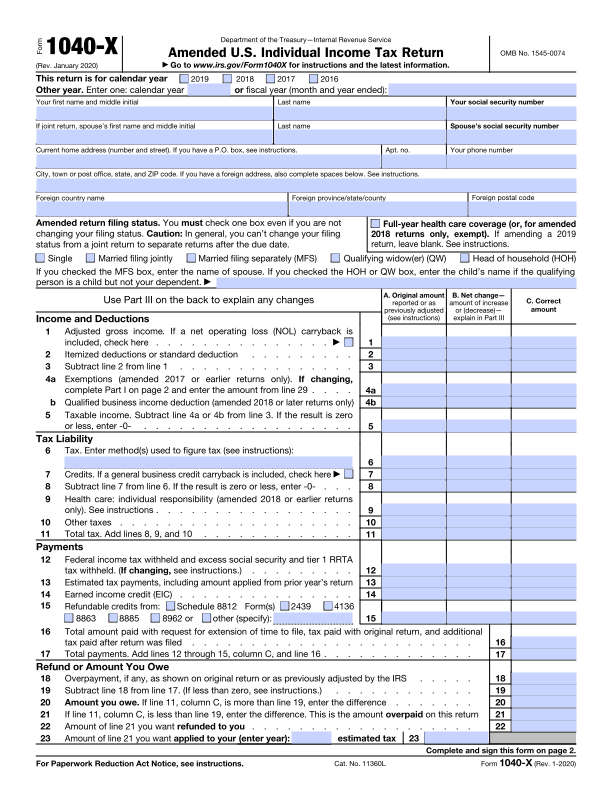

Form 1040X Amended Income Tax Return

Form 1040X Amended Income Tax Return

We are all human and do make some mistakes. Even if we are very careful and cautious of the information, we enter on our tax returns, sometimes there are items we miss. If you discover an error on your personal income tax return IRS Forms 1040, 1040A or 1040-EZ, the next step is knowing the mistake that was made and how it should be resolved. In many cases, you will need to complete IRS Form 1040-X also known as an Amended Income Tax Return, which we will cover in this article.

What Is the IRS Form 1040-X Amended Tax Return?

The purpose of IRS Form 1040-X is to make changes to your return after the deadline. These changes could be an increase or decrease in your income or if your business suffered a loss, as an example. When you file Form 1040-X to correct a tax year, it now becomes your new tax return for that year as it changes your original return to include new information.

You should not file this return if you are requesting a refund of penalties or interest, however, you would need to file Form 843, Claim for Refund.

What Information Do I Need to Amend My Return?

To Amend a return, you will need a copy of your original return which should include supporting forms (W2, 1099, 1098, etc.), schedules and any worksheets you completed. In addition, you will need the following:

- Notices from the IRs on any adjustments to that return, and

- Instructions for the return you are amending.

- Remember to change your State return as that has needs to be amended as well.

If you are amending a return for more than one year, you will need to file a separate Form 1040-X for each tax year you are amending.

Some reasons you would amend a return:

- If you received a corrected W2 or 1099

- If you neglected to enter in a charitable contribution

- If you did not receive a K1 timely and filed your return based on other information for your income

- If you received money from a dividend or other retirement vehicle, but didn’t receive a 1099-DIV when you filed your original return and forgot to enter this income on your return.

How Long Do I Have to Correct My Return?

If you discover a mistake, it’s important to file an Amended Return as quickly as possible, especially if you are increasing a refund amount. There is a three-year Statute of Limitations on filing when you expect a refund. However, if you are going to amend to zero out your tax liability or will have a balance due, you can file when able, but again, better to file as soon as you discover the error. If the IRS finds the error first, it could cause additional penalties and interest to accrue making it a larger mistake than you intended.

How Do I Know If I Need to Correct My Return?

There could be several red flags alerting you that you should probably amend your return. For example, the IRS discovers the discrepancy and send you a notice of balance due. Or, as mentioned above, you receive a tax form reminding you of income or a deduction confirmation but was received only after you filed your original tax return.

How Should I Send in an Amended Tax Return?

Once you are ready to submit your IRS Form 1040-X if you are amending tax year 2019 you can now do so electronically with tax filing software.

However, in most cases, you will be amending a previous year tax return and that must be done via mail. You will need to have the instructions handy as this will tell you where to file the Amended Return. In addition, you must include your original return with the Amended to show what changes you are making.

If you will owe, be sure to send in your payment in full using the vouchers available here IRS Payment Vouchers

If you have questions on how to amend your tax return or unsure if you need to do so, reach out to one of our knowledgeable tax professionals.

What Happens If I Don’t Correct My Return?

It would depend on the mistake that was made. Typically, if it’s small, the IRS will merely make the change for you and send you a notice of the minute change that was made.

However, if it’s a large mistake that affects your income amount or deductions, it could be costly. You could be missing out on a refund, or it could cause an Audit as there was underreported income or a failure to report, which comes with its own penalties and interest.

What If I Can’t Pay the Amount in Full?

If you need to correct a return and find you will owe, there are options available to pay the tax owed. It’s best to talk to a tax resolution specialist to ensure you are requesting the right resolution for you based on your personal financial condition.

Installment Agreement

There are many Installment Agreements available to assist taxpayers who owe $10,000 or less to $100,000 or less. Choosing the right one is based on your balance due, the collection statute end date and what amount could you afford to pay monthly until your balance due reaches zero. In addition, there are options available to avoid a Federal Tax Lien from being filed.

Offer in Compromise

This option is much harder to obtain and is used for taxpayers who cannot possibly pay the tax liability owed as it would cause an undue financial hardship. Before heading down this road, it’s best to contact a tax resolution specialist for more information and guidance to ensure this is your best option available.

Currently Not Collectible Status

In some cases, the IRS will agree you are unable to pay your tax debt without it causing a financial hardship. Typically, they will allow you to not make any payments for two years with a review at that time. In this case, although you are not required to make payments, penalties and interest will continue to accrue.

First Time Penalty Abatement

You have filed and paid your taxes on time every year, except this year as there was so much going on. The IRS will offer a one-time forgiveness of the Failure to File and Failure to Pay Penalties. To qualify, you cannot have had the same penalties within the last three filing years.

I Think I Need to Hire a Tax Professional!

Here at Legacy Tax we are ready and wanting to help. We understand these forms can be confusing and want to ensure you are maximizing your tax credits by using the correct form.

Call us today for a free consultation. 1-800-829-7483

Printable PDF