March 14, 2023

Form 5754- Group Gambling Winnings

Form 5754- Group Gambling Winnings

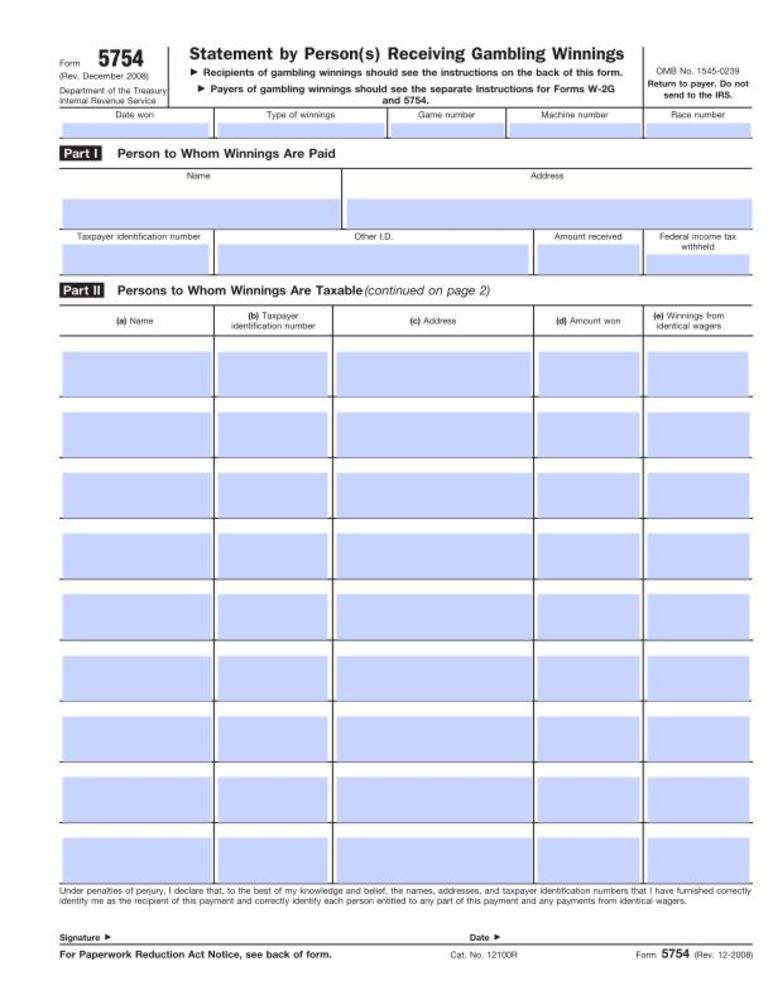

Use Form 5754, Statement by Person(s) Receiving Gambling Winnings, to prepare Form W-2G only when the person receiving gambling winnings subject to reporting or withholding isn't the actual winner or is a member of a group of two or more people sharing the winnings, such as by sharing the proceeds of the same winning ticket. The payer is required to file Forms W-2G based on Form 5754.

The person receiving the winnings must furnish all the information required by Form 5754. However, a recipient of winnings from a state-conducted lottery need not provide identification other than his or her taxpayer identification number (TIN).

Part I lists the identification of the person to whom the winnings are paid, and Part II lists the actual winners, their respective shares of the winnings, and any additional winnings from Identical Wagers. Identical wagers are defined earlier in the Specific Instructions for Form W-2G.

In Part II, the person receiving the winnings must provide the name, address, TIN, respective share of the winnings, and additional winnings from identical wagers for each of the winners. In addition, if regular gambling withholding is required, the form must be signed, under penalties of perjury, and dated by the person receiving the winnings.

The form must be returned to the payer for preparation of Form W-2G for each of the persons listed as winners. Forms W-2G may be issued immediately or by January 31 following the year of the payment.

Do not send Form 5754 to the IRS. Keep it for your records.

Specific Instructions for Form W-2G

File Form W-2G, Certain Gambling Winnings, to report gambling winnings and any federal income tax withheld on those winnings. The requirements for reporting and withholding depend on the type of gambling, the amount of the gambling winnings, and generally the ratio of the winnings to the wager. File Form W-2G with the IRS. You must provide a statement to the winner (Copies B and C of Form W-2G).

The types of gambling are discussed in these instructions under the following four headings.

1. Horse Racing, Dog Racing, Jai Alai, and Other Wagering Transactions Not Discussed Later.

2. Sweepstakes, Wagering Pools, and Lotteries.

3. Bingo, Keno, and Slot Machines.

4. Poker Tournaments.

Reportable Gambling Winnings

Report gambling winnings on Form W-2G if:

The winnings (not reduced by the wager) are $1,200 or more from a bingo game or slot machine;

The winnings (reduced by the wager) are $1,500 or more from a keno game;

The winnings (reduced by the wager or buy-in) are more than $5,000 from a poker tournament;

The winnings (except winnings from bingo, slot machines, keno, and poker tournaments) reduced, at the option of the payer, by the wager are:

$600 or more, and

At least 300 times the amount of the wager; or

The winnings are subject to federal income tax withholding (either regular gambling withholding or backup withholding).

Tax-Exempt Organizations

A tax-exempt organization conducting gaming activities may be required to withhold income tax and report on Form W-2G. See Pub. 3079, Tax-Exempt Organizations and Gaming.

Withholding

There are two types of withholding on gambling winnings: (a) regular gambling withholding at 24% (31.58% for certain noncash payments), and (b) backup withholding that is also at 24%. If a payment is already subject to regular gambling withholding, it isn't subject to backup withholding.

Regular Gambling Withholding for Certain Games

You may be required to withhold 24% of gambling winnings for federal income tax. This is referred to as regular gambling withholding. Withhold at the 24% rate if the winnings minus the wager are more than $5,000 and are from:

Sweepstakes;

Wagering pools;

Lotteries;

Wagering transactions in a parimutuel pool with respect to horse races, dog races, or jai alai, if the winnings are at least 300 times the amount wagered; or

Other wagering transactions, if the winnings are at least 300 times the amount wagered.

Regular gambling withholding doesn't apply to winnings from bingo, keno, or slot machines, nor does it apply to winnings from other wagering transactions if the winnings are $5,000 or less. However, see Backup Withholding, later.

Regular gambling withholding is figured on the total amount of gross proceeds (the amount of winnings minus the amount wagered), not merely on the amount in excess of $5,000.

Report the amount you withheld in box 4 of Form W-2G. Also, file Form 945, Annual Return of Withheld Federal Income Tax, to report all your gambling withholding.

Noncash payments.

You must take the fair market value (FMV) of a noncash payment, such as a car in a sweepstakes, wagering pool, or lottery, into account for purposes of reporting and withholding. If the FMV exceeds $5,000, after deducting the price of the wager, the winnings are subject to 24% regular gambling withholding. The tax you must withhold is computed and paid under either of the following two methods.

The winner pays the withholding tax to the payer. In this case, the withholding is 24% of the FMV of the noncash payment minus the amount of the wager.

The payer pays the withholding tax. In this case, the withholding is 31.58% of the FMV of the noncash payment minus the amount of the wager.

If you use method 2, enter the sum of the noncash payment and the withholding tax in box 1 of Form W-2G and the withholding tax paid by the payer in box 4.

Backup Withholding

You may be required to withhold 24% of gambling winnings (including winnings from bingo, keno, slot machines, and poker tournaments) for federal income tax. This is referred to as backup withholding. You should backup withhold if:

The winner doesn't furnish a correct taxpayer identification number (TIN),

Regular gambling withholding hasn't been withheld, and

The winnings are at least $600 and at least 300 times the wager (or the winnings are at least $1,200 from bingo or slot machines or $1,500 from keno, or more than $5,000 from a poker tournament).

Figure any backup withholding on the total amount of the winnings reduced, at the option of the payer, by the amount wagered. This means the total amount, not just the payments in excess of $600, $1,200, $1,500, or $5,000, is subject to backup withholding.

Report the amount you withheld in box 4 of Form W-2G. Also, file Form 945 to report all backup withholding. You may use Form W-9, Request for Taxpayer Identification Number and Certification, to request the TIN of the recipient.

See the following instructions for each type of gambling for detailed rules on backup withholding.

Foreign Persons

Payments of gambling winnings to a nonresident alien individual or a foreign entity aren't subject to reporting or withholding on Form W-2G. Generally, gambling winnings paid to a foreign person are subject to 30% withholding under sections 1441(a) and 1442(a) and are reportable on Form 1042, Annual Withholding Tax Return for U.S. Source Income of Foreign Persons, and Form 1042-S, Foreign Person's U.S. Source Income Subject to Withholding. Winnings of a nonresident alien from blackjack, baccarat, craps, roulette, big-6 wheel, or a live dog or horse race in the United States from legal wagers initiated outside the United States in a parimutuel pool aren't subject to withholding or reporting. See Pub. 515, Withholding of Tax on Nonresident Aliens and Foreign Entities.

State Tax Information

Boxes 13, 14, and 15 and Copies 1 and 2 are provided for your convenience only and don't have to be completed for the IRS. If you withheld state income tax on a payment of gambling winnings, you may enter it in box 15 of Form W-2G. If you do, also complete boxes 13 and 14. A state identification number (box 13) is assigned by each individual state.

If a state tax department requires you to send it a paper copy of Form W-2G, use Copy 1 for that purpose. Give Copy 2 to the winner for use in filing a state income tax return.

Local Tax Information

Boxes 16, 17, and 18 and Copies 1 and 2 are provided for your convenience only and don't have to be completed for the IRS. If you withheld local income tax on a payment of gambling winnings, you may enter it in box 17 of Form W-2G. If you do, also complete boxes 16 and 18.

Form 5754

If the person receiving the winnings isn't the actual winner, or is a member of a group of winners, see Specific Instructions for Form 5754,later.

Statements to Winners

If you are required to file Form W-2G, you must also provide a statement to the winner. For information about the requirement to furnish a statement to the winner, see part M in the current General Instructions for Certain Information Returns. You may furnish Copies B and C of Form W-2G to the winner.

1. Horse Racing, Dog Racing, Jai Alai, and Other Wagering Transactions Not Discussed Later

File Form W-2G for every person to whom you pay $600 or more in gambling winnings if the winnings are at least 300 times the amount of the wager. If the person presenting the ticket for payment is the sole owner of the ticket, complete Form W-2G showing the name, address, and TIN of the winner. If regular gambling withholding is required, the winner must sign Form W-2G, under penalties of perjury, stating that he or she is the sole owner and that the information listed on the form is correct. If more than one person shares in the winnings from a single wager, see Withholding and Forms W-2G for Multiple Winners, later.

Withholding

You must withhold federal income tax from the winnings if the winnings minus the wager exceed $5,000 and the winnings are at least 300 times the wager. Withhold 24% of the proceeds (the winnings minus the wager). This is regular gambling withholding.

If the winner of reportable gambling winnings doesn't provide a TIN, you must backup withhold on any such winnings that aren't subject to regular gambling withholding. The backup withholding rate is identical to the regular withholding rate of 24%. That is, backup withholding of 24% applies if the winnings are at least $600 but not more than $5,000 and are at least 300 times the wager. Figure backup withholding on the amount of the winnings reduced, at the option of the payer, by the amount wagered.

Identical Wagers

Winnings from "identical wagers" are added together for purposes of reporting and withholding requirements. Two or more wagers are identical wagers if they are placed with the same payer and winning depends on the occurrence (or non-occurrence) of the same event or events. In the case of horse races, dog races, or jai alai, wagers must also be placed in the same parimutuel pool to be identical wagers. For example, multiple bets placed in a parimutuel pool with a single payer on the same horse to win a specific race are identical wagers.

Wagers in a Single Parimutuel Pool in Horse Racing, Dog Racing, or Jai Alai

All wagers in horse racing, dog racing, or jai alai placed in a single parimutuel pool and represented on a single ticket are aggregated and treated as a single wager for purposes of determining the amount of the wager for withholding and reporting requirements. These types of wagers are not necessarily identical wagers. For example, two bets in a single show pool, one for Player X to show and the other for Player Y to show, are not identical wagers because winning on the two bets isn't contingent on the occurrence of the same event. However, if both bets are represented on a single ticket, then they must be aggregated to determine the amount of the wager.

Box 1

Enter payments of $600 or more if the payment is at least 300 times the wager.

Box 2

Enter the date of the winning event. This isn't the date the money was paid if it was paid after the date of the race (or game).

Box 3

Enter the type of wager if other than a regular race bet, for example, Daily Double or Big Triple.

Box 4

Enter any federal income tax withheld, whether regular gambling withholding or backup withholding.

Box 5

Not applicable.

Box 6

Enter the race (or game) applicable to the winning ticket.

Box 7

Enter the amount of additional winnings from identical wagers.

Box 8 or 10

Enter the cashier and/or window number making the winning payment.

Box 9

This is required information. Enter the TIN of the person receiving the winnings. For an individual, this will be the social security number (SSN) or individual taxpayer identification number (ITIN). If the winner fails to give you a TIN, backup withholding applies. See Withholding, earlier.

Boxes 11 and 12

As verification of the name, address, and TIN of the person receiving the winnings, enter the identification numbers from two forms of identification. Acceptable forms of identification include a driver's license, passport, social security card, military identification card, tribal member identification card issued by a federally recognized Indian tribe, voter registration card, or completed and unmodified Form W-9. Enter the number and the state or jurisdiction. In some instances, the number may be the same number as in box 9.

One of the two forms of identification that the recipient presents must include the recipient's photograph. Gaming establishments owned or licensed by a tribal government may waive the photo ID requirement for payees who are members of that federally recognized Indian tribe and present a tribal member identification card issued by the same tribal government.

Boxes 13 Through 18

These boxes are provided for your convenience only and need not be completed for the IRS. See State Tax Information and Local Tax Information, earlier.

Box 13.

Enter the abbreviated name of the state and your state identification number.

Box 14.

Enter the amount of state winnings.

Box 15.

Enter the amount of state income tax withheld.

Box 16.

Enter the amount of local winnings.

Box 17.

Enter the amount of local income tax withheld.

Box 18.

Enter the name of your locality.

2. Sweepstakes, Wagering Pools, and Lotteries

File Form W-2G for each person to whom you pay $600 or more in gambling winnings from a sweepstakes, wagering pool, or lottery (including a state-conducted lottery) if the winnings are at least 300 times the amount of the wager. The wager must be subtracted from the total winnings to determine whether withholding is required and, at the option of the payer, to determine whether reporting is required. The wager must be subtracted at the time of the first payment.

The requirements in this section apply to church raffles, charity drawings, etc. In the case of one wager for multiple raffle tickets, such as five for $1, the wager is considered as $.20 for each ticket.

Withholding

You must withhold federal income tax from the winnings if the winnings minus the wager exceed $5,000. Withhold 24% of the proceeds (the winnings minus the wager). This is regular gambling withholding. If the winner of reportable gambling winnings doesn't provide a TIN, you must backup withhold on any such winnings that aren't subject to regular gambling withholding at the same withholding rate of 24%. That is, backup withholding of 24% applies if the winnings are at least $600 but not more than $5,000 and are at least 300 times the wager. Figure backup withholding on the amount of the winnings reduced, at the option of the payer, by the amount wagered.

Installment payments of $5,000 or less are subject to regular gambling withholding if the total proceeds from the wager will exceed $5,000.

If payments are to be made for the life of a person (or for the lives of more than one person), and it is actuarially determined that the total proceeds from the wager are expected to exceed $5,000, such payments are subject to 24% regular gambling withholding. When a third party makes the payments, for example, an insurance company handling the winnings as an annuity, that third party must withhold.

When Paid

A payment of winnings is considered made when it is paid, either actually or constructively, to the winner. Winnings are constructively paid when they are credited to or set apart for that person without any substantial limitation or restriction on the time, manner, or condition of payment. However, if not later than 60 days after the winner becomes entitled to the prize, the winner chooses the option of a lump sum or an annuity payable over at least 10 years, the payment of winnings is considered made when actually paid. If the winner chooses an annuity, file Form W-2G each year to report the annuity paid during that year.

Identical Wagers

Winnings from "identical wagers" are added together for purposes of the reporting and withholding requirements. Two or more wagers are identical wagers if they are placed with the same payer and winning depends on the occurrence (or non-occurrence) of the same event or events.

Box 1

Enter payments of $600 or more if the payment is at least 300 times the wager.

Box 2

Enter the date of the winning transaction, such as the date of the drawing of the winning number. This might not be the date the winnings are paid.

Box 3

Enter the type of wager (such as raffle or 50-50 drawing) or the name of the lottery (such as Instant, Big 50, Baker's Dozen, or Powerball) and the price of the wager ($.50, $1, etc.).

Box 4

Enter any federal income tax withheld, whether regular gambling withholding or backup withholding.

Box 5

For a state lottery, enter the ticket number or other identifying number.

Boxes 6, 8, and 10

Not applicable.

Box 7

Enter the amount of additional winnings from identical wagers.

Box 9

This is required information. Enter the TIN of the person receiving the winnings. For an individual, this will be the social security number (SSN) or individual taxpayer identification number (ITIN). If the winner fails to give you a TIN, backup withholding applies. See Withholding under Sweepstakes, Wagering Pools, and Lotteries, earlier.

Boxes 11 and 12

Except for winnings from state lotteries, as verification of the name, address, and TIN of the person receiving the winnings, enter the identification numbers from two forms of identification. Acceptable forms of identification include a driver's license, passport, social security card, military identification card, tribal member identification card issued by a federally recognized Indian tribe, voter registration card, or completed and unmodified Form W-9. Enter the number and the state or jurisdiction. In some instances, the number may be the same number as in box 9.

One of the two forms of identification that the recipient presents must include the recipient's photograph. Gaming establishments owned or licensed by a tribal government may waive the photo ID requirement for payees who are members of that federally recognized Indian tribe and present a tribal member identification card issued by the same tribal government.

Boxes 13 Through 18

These boxes are provided for your convenience only and need not be completed for the IRS. See State Tax Information and Local Tax Information, earlier.

Box 13.

Enter the abbreviated name of the state and your state identification number.

Box 14.

Enter the amount of state winnings.

Box 15.

Enter the amount of state income tax withheld.

Box 16.

Enter the amount of local winnings.

Box 17.

Enter the amount of local income tax withheld.

Box 18.

Enter the name of your locality.

3. Bingo, Keno, and Slot Machines

File Form W-2G for every person to whom you pay $1,200 or more in gambling winnings from bingo or slot machines, or $1,500 or more from keno after the price of the wager for the winning keno game is deducted. If the winnings aren't paid in cash, the FMV of the item won is considered the amount of the winnings. Total all winnings from all wagers made during a single bingo or keno game to determine whether the winnings are reportable. Winnings and losses from other wagering transactions aren't to be taken into account in arriving at the $1,200 or $1,500 figure.

Withholding

Regular gambling withholding doesn't apply to winnings from bingo, keno, or slot machines. However, if the recipient of reportable gambling winnings from bingo, keno, or slot machines doesn't provide a TIN, you must backup withhold. That is, if the winnings are at least $1,200 from bingo or slot machines or $1,500 from keno, backup withholding of 24% applies to the amount of the winnings reduced, at the option of the payer, by the amount wagered.

Box 1

Enter payments of $1,200 or more from bingo or slot machines or payments of $1,500 or more from keno.

You may use the optional aggregate reporting method to report these payments. Under this method, aggregate multiple payments of reportable gambling winnings from bingo, keno, or slot machines received by a payee in a 24-hour calendar day or “gaming day” on a single Form W-2G. A “gaming day” is a 24-hour period that ends at a particular time chosen by the gaming establishment (generally when the establishment is closed or when business is slowest, such as between 3:00 a.m. and 6:00 a.m.). On December 31st, all open information reporting periods must close at 11:59 p.m. to end by the end of the calendar year. On January 1st, all information reporting periods must begin at 12:00 a.m. For more details and recordkeeping requirements, see Regulations section 1.6041-10(g).

Box 2

Enter the date of the winning transaction.

Box 3

Enter the type of wager (that is, bingo, keno, or slot machines) and the amount of the wager.

Box 4

Enter any backup withholding.

Box 5

Enter the ticket number, card number (and color, if applicable), machine serial number, or any other information that will help identify the winning transaction.

Boxes 6 and 7

Not applicable.

Box 8

Enter the initials of the person paying the winnings.

Box 9

This is required information. Enter the TIN of the person receiving the winnings. For an individual, this will be the social security number (SSN) or individual taxpayer identification number (ITIN). If the winner fails to give you a TIN, backup withholding applies. See Withholding under Bingo, Keno, and Slot Machines, earlier.

Box 10

Enter the location of the person paying the winnings, if applicable.

Boxes 11 and 12

As verification of the name, address, and TIN of the person receiving the winnings, enter the identification numbers from two forms of identification. Acceptable forms of identification include a driver's license, passport, social security card, military identification card, tribal member identification card issued by a federally recognized Indian tribe, voter registration card, or completed and unmodified Form W-9. Enter the number and the state or jurisdiction. In some instances, the number may be the same number as in box 9.

One of the two forms of identification that the recipient presents must include the recipient's photograph. Gaming establishments owned or licensed by a tribal government may waive the photo ID requirement for payees who are members of that federally recognized Indian tribe and present a tribal member identification card issued by the same tribal government.

Boxes 13 Through 18

These boxes are provided for your convenience only and need not be completed for the IRS. See State Tax Information and Local Tax Information, earlier.

Box 13.

Enter the abbreviated name of the state and your state identification number.

Box 14.

Enter the amount of state winnings.

Box 15.

Enter the amount of state income tax withheld.

Box 16.

Enter the amount of local winnings.

Box 17.

Enter the amount of local income tax withheld.

Box 18.

Enter the name of your locality.

4. Poker Tournaments

File Form W-2G for each person to whom you pay more than $5,000 in winnings, reduced by the amount of the wager or buy-in, from each poker tournament you have sponsored. Winnings and losses of the participant from other poker tournaments you have sponsored during the year aren't taken into account in arriving at the $5,000 amount.

Withholding and backup withholding.

If you file Form W-2G for the person to whom you pay more than $5,000 in net winnings from a poker tournament, and provide a copy of Form W-2G to such person, regular gambling withholding doesn't apply to the winnings. However, if the person who wins more than $5,000 doesn't provide a TIN, you must apply backup withholding to the full amount of the winnings from the tournament at the backup withholding rate of 24%. Net winnings of $5,000 or less aren't subject to reporting, withholding, or backup withholding.

Box 1

Enter payments of more than $5,000 in net gambling winnings from a poker tournament.

Box 2

Enter the date of the poker tournament.

Box 3

Enter "poker tournament" in the entry space.

Box 4

Enter zero as the amount, unless the winning person hasn't provided a TIN. If the winning person hasn't provided a TIN, enter the backup withholding amount.

Box 5

Enter the name of the tournament and its sponsor.

Boxes 6 Through 8 and Box 10

Not applicable.

Box 9

This is required information. Enter the TIN of the person receiving the winnings. For an individual, this will be the social security number (SSN) or individual taxpayer identification number (ITIN). If the winner fails to give you a TIN, backup withholding applies. See Withholding and backup withholding, earlier.

Boxes 11 and 12

As verification of the name, address, and TIN of the person receiving the winnings, enter the identification numbers from two forms of identification. Acceptable forms of identification include a driver's license, social security card, or voter registration. Enter the number and the state or jurisdiction. In some instances, the number may be the same number as in box 9.

Boxes 13 Through 18

These boxes are provided for your convenience only and need not be completed for the IRS. See State Tax Information and Local Tax Information, earlier.

Box 13.

Enter the abbreviated name of the state and your state identification number.

Box 14.

Enter the amount of state winnings.

Box 15.

Enter the amount of state income tax withheld.

Box 16.

Enter the amount of local winnings.

Box 17.

Enter the amount of local income tax withheld.

Box 18.

Enter the name of your locality.

Printable PDF