June 2, 2020

IRS Just Sent Me a Notice of Intent to Levy- Intent to Terminate Your Installment Agreement (CP 523) – What Should I Do?

IRS Just Sent Me a Notice of Intent to Levy- Intent to Terminate Your Installment Agreement (CP 523) – What Should I Do?

The IRS goes through a series of notices in their collections system, from Cold (barely on the radar) to Smoldering Hot (requires immediate attention). Check out the links to learn more:

- CP14 - Not too scary (Cold).

- CP501 - Still pretty cool (Getting warmer).

- CP503 - Getting warmer still

- CP504 - Getting uncomfortable

- Letter 1058/Letter 11 - (Final Levy Notice)—Smoldering hot—act now or lose your due process rights (your right to a hearing and a stop of collection)

- CP90/CP91 - Another type of Final Notice of Intent to Levy (Smoldering hot)

- CP92 or CP 242- IRS Seized Your State Tax Refund to Your Unpaid Federal Liabilities- (Smoldering hot, you just lost some money)

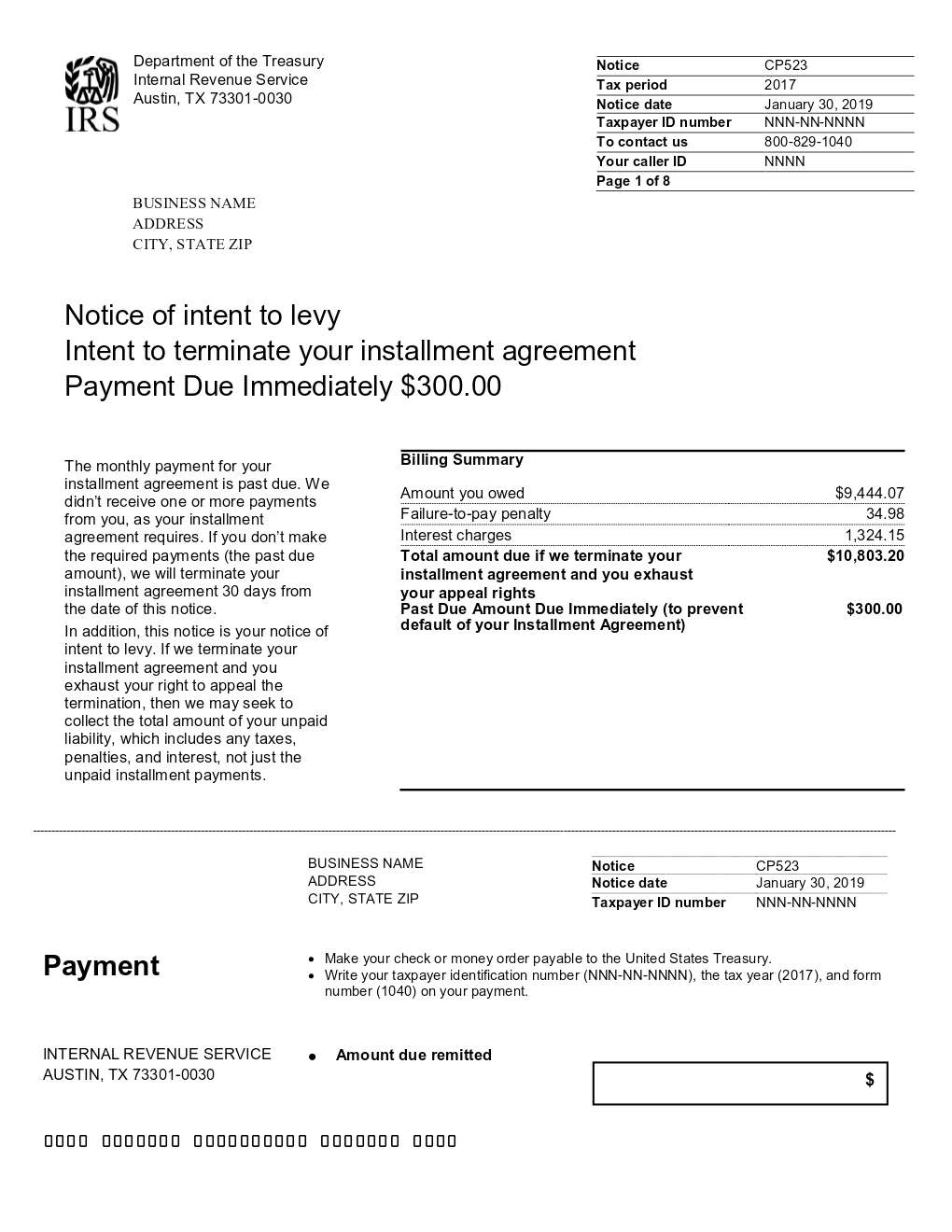

- CP 523- Notice of Intent to Levy- Intent to Terminate Your Installment Agreement. (Red hot, the IRS will levy unless you take action)

- CP71 - 10 Day Final Notice of Intent to Levy. You have already received a Final Notice more than 6 months ago. Act now!

This notice is CP 523 IRS Seized Your State Tax Refund to Your Unpaid Federal Liabilities. Generally, the IRS sends this notice by certified mail after you have default on an installment agreement, have new balances or unfiled tax returns.

What the CP523 means is that the installment agreement was placed into default status but is not yet terminated as of the date listed on the notice. When the installment agreement is in default status, taxpayers have the right to request an appeal. This is commonly referred to as a CAP appeal and gives taxpayers the right to review the reason for removal and to ask for reinstatement.

What can I expect because of this notice?

The IRS must notify of the potential collection actions that will happen next and the Intent to Seize Your Assets and Notice of Your Right to a Hearing does just that, by giving you notice they are considering sending a wage levy to your employer or bank levy to you bank or even taking your personal property or real estate.

Tax laws give you 30 days after the date of your CP 523 notice to file an appeal. Filing your appeal is extremely important as it stops the IRS from taking collections actions against you while it is pending. This enables you to continue to protect your wages, financial accounts, and assets from the IRS while you are working out a solution.

If more than 30 days have passed since the IRS sent you the final notice, your still can file an appeal. The IRS will give you up to a year after the notice to file for an appeal. It is important to understand by missing the 30 deadline to appeals, you gave up the right to stop collections while your appeal is pending.

After the appeal is filed, procedurally, it will take the IRS about 15 to 30 days to assign it to an Appeals Officer. Once the case has been forwarded to Appeals Officer, that person will send you a letter with a hearing date and time.

IRS settlement officers are not collection employees and are trained to settle unpaid tax cases. Their job is to resolve problems and discuss collection options. Solutions that the IRS Appeals Officer can consider include an Offer in Compromise, a monthly Installment Agreement or payment plan, Currently Not Collectible Status and even penalty abatement. After you have reached a resolution with the settlement officer (without the threat of levy, if timely filed), the IRS must abide by it.

What can I expect next after this notice?

If you do not contact the IRS to discuss resolution options or file an appeal, you can expect a wage garnishment or wage levy, bank levy, asset seizure or some combination.

What are my options?

What is my first step?

If you received a letter or notice, a decision must be made. Do you feel confident to handle this situation on your own? If it is a simple issue and you already know the answer, call, or write them. If the issue is more complicated, you need to hire a Certified Tax Resolution Specialist. The IRS or State will take full advantage of your lack of knowledge and experience.

What is Your Next Step?

The next step is to determine if the notice was sent in error. Do you have an outstanding tax liability? Do you have unfiled or incomplete returns?

Is There a Time Limit?

Yes! Each letter or notice from the IRS or State will indicate a date that you MUST contact them by. If you need more time, call the number on the notice or letter, and request an extension. DO NOT ALLOW the time to expire without contacting them or hiring a representative to contact them for you.

What You Don’t Want to Do!

What you don’t want to do is nothing. Your tax problems will only get worse if you ignore them. If you cannot pay, there are a number of potential solutions available to those who are otherwise in compliance. In compliance means having all tax returns filed and any balances paid or on a payment plan. If you have outstanding debts or unfiled returns, you need to get hire a Certified Tax Resolution Specialist.

Get Some Help

If you don’t know how to address the issue(s), have unfiled returns/unpaid balances or just done feel confident, let the experts at Legacy Tax & Resolution Services represent you. Work with our team of Certified Tax Resolution Specialists to resolve your issue(s) quickly. Best of all, you don’t have to talk to the IRS or State; we can speak on your behalf.

Stop the stress and resolve your problems Call 800-829-7483 TODAY

Download our Special Report “ Final Notice of Intent To Levy- What Happens Next?”

In it you will find next steps, dos and don’ts and information about your options

We Offer Financing for Our Tax Resolution Fees

Stop the stress and resolve your problems!

Call 800-829-7483 for a FREE Consultation

Printable PDF