September 12, 2021

W-9 Form Independent Contractor | How to Fill Out W-9 Form for Individual

W-9 Form Independent Contractor | How to Fill Out W-9 Form for Individual

For Information on other forms, check out or Forms Library

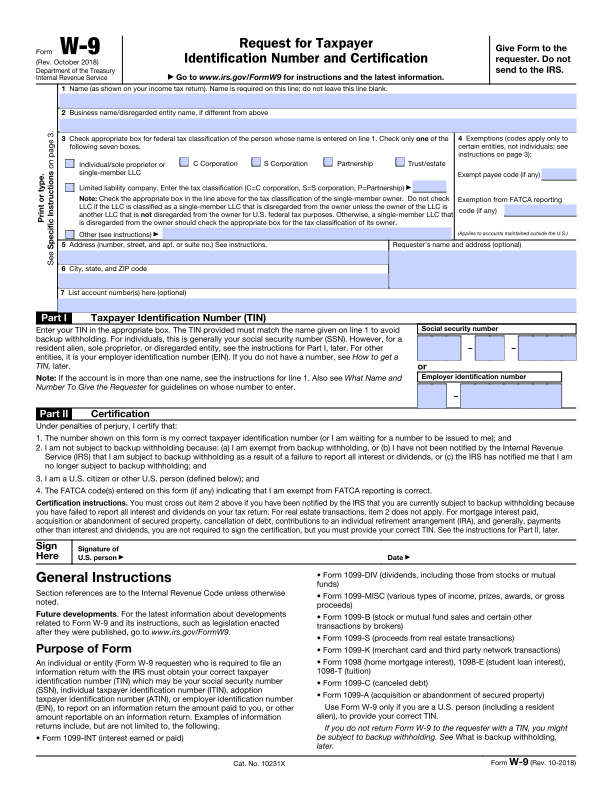

Form W-9 IRS is used to provide your correct Taxpayer Identification Number (TIN) to the person who is required to file an information return with the IRS such as a form 1099-M

Form W-9 IRS is completed by independent contractor, consultants or self-employed individuals. If you’ve hired a contractor or freelancer, this is a form you should request as part of your hiring process.

What Is a W-9?

Form W-9 IRS includes the worker’s:

- Name

- Address

- Taxpayer Identification Number (TIN), or

- Social Security Number (SSN), or

- Employee Identification Number (EIN)

Examples of when you would be requested to complete Form W-9 IRS are;

- Income paid to you.

- Real estate transactions.

- Mortgage interest you paid.

- Acquisition or abandonment of secured property.

- Cancellation of debt.

- Contributions you made to an IRA.

The Purpose of a Form W-9 IRS

The person or business that hires you will typically ask you to fill out Form W-9 IRS. Any businesses that pays an independent contractor more than $600 during the tax year must report these payments to the IRS on Form 1099-MISC. The information provided on Form W-9 allows the business owners to complete Form 1099-MISC.

Businesses who hire independent contractors aren’t obligated to pay Medicare, Social Security, or withhold income taxes for the independent contractor. It is the independent contractor or self-employed individual responsibility to make estimated payments.

Substitute Form W-9 IRS

You may develop and use your own Form W-9 IRS (a substitute Form W-9) if its content is substantially similar to the official Form W-9 IRS and it satisfies certain certification requirements. You may incorporate a substitute Form W-9 IRS into other business forms you customarily use, such as account signature cards. However, the certifications on the substitute Form W-9 must clearly state (as shown on the official Form W-9) that under penalties of perjury:

1. The payee's TIN is correct,

2. The payee is not subject to backup withholding due to failure to report interest and dividend income,

3. The payee is a U.S. person, and

4. The FATCA code entered on this form (if any) indicating that the payee is exempt from FATCA reporting is correct.

Information Required to Fill Out a Form W-9 IRS

The instructions on IRS Form W-9 are straight forward. If you are an independent contractor operating as a sole proprietor, you must report your name, provide your Social Security number, and verify whether you are exempt from backup withholding taxes. If the contractor is operating as a business, they would be required to report the name of their business, what type of business, tax identification number and verify whether you are exempt from backup withholding taxes. If the contractor you have hired is not exempt from backup withholding, you must withhold income tax from their contractor’s pay at a rate of 28 percent and send it directly to the IRS.

How to Fill Out Form W-9 IRS

- Section 1: Enter your name as shown on your tax return.

- Section 2: If your independent contracting using a business name, enter that business name here.

- Section 3: Enter the type of business entity (C Corp, S Corp, Partnership). If you are a limited liability company, list the tax classification (C Corp, S Corp, Partnership). Most self-employed workers are sole proprietorships.

- Section 4: State your exemption code. This applies to certain entities, not individuals. See page 3 of the instructions. Most people will probably leave this section blank, unless you’re exempt from backup withholding.

- Section 5/6/7: Provide your street address, city, state, and zip code. If your home address is different from your business address and your are a sole proprietor, use the address that you’re going to use on your personal tax return. If you are an entity, use the address that will be listed on the entities return.

- Requester’s Name and Address (Optional): This is an optional section where you can fill in the name of the person or business requesting your W-9 form. It’s best to do so for record-keeping purposes.

- Part I: Is refer in “Part I.” of the instructions. If you’re a sole proprietorship, enter your social security number. If you’re another type of business entity, enter your tax identification number. If you’re a brand-new business write “applied for” if that’s the case. You must get your tax identification number as soon as possible because you’ll be subject to backup withholding until you do.

- Part II is referred to in “Part II.” of the instructions. You’ll have a series of statements to assign to attest that everything you’ve entered on your W-9 form is truthful.

- Sign Here: It is critical that you sign, without it, the document is not valid.

- Date: It is important that you include the date

Exercise Caution When Completing the Form W-9 IRS

Form W-9 contains extremely sensitive tax information, including a tax identification numbers or your Social Security number, so it is very important to you protect it from identity theft.

Note: As an employer, it’s your responsibility to retain a contractor’s Form W-9 IRS in a safe place.

What If I Don’t Recognize Where the Form W-9 IRS Came From?

Since Form W-9 contains lots of sensitive personal information, it’s a popular method for people to trying to commit fraud or identity theft.

Here are a couple red flags to watch for:

- You don’t recognize the name of the business or individual who sent you the Form W-9 IRS. Don’t fill it out or forward it until you have confirmed the sender. If you were recently hired for contract work, confirm with the company where the Form W-9 is coming from. If you received the form digitally, confirm the source. If they refuse to answer your questions or give you vague answers, don’t give them your information.

- You expected Form W-4 instead. When you receive your tax documents to complete for the first time, double check to see whether you’re filling out a W-4 or W-9. If you received a Form W-9 IRS and didn’t expect it, clarify whether you’re being hired as an employee or an independent contractor. A W-4 for is completed by an employee and a W-9 is completed by an independent contractor. Some employers attempt to hire people as an independent contractor to save money, even though they were promised to be hired as an employee. A W-4 form is meant to set up the employee’s tax withholdings, while the Form W-9 IRS makes the contractor responsible for their withholdings on their own.

- You’re asked to complete Form W-9 IRS over the phone. You should fill out a physical or digital copy of Form W-9—don’t let anyone take your information on the phone, because that is something someone who intends to commit fraud or steal your identity would do.

If you feel uncomfortable about the source of the Form W-9 IRS you received, you should contact one of the tax professional at Legacy Tax & Resolution Services. We can give you advice on how to proceed.

Use a Secured Method of Delivery

Make sure you deliver your W-9 form via a secured delivery method. Secured delivery methods include mail, hand delivery, or an encrypted email attachment. Never send your Form W-4 as an unencrypted email attachment. Unencrypted email can get easily be hacked by identity thieves.

What If I’m Subject to Mandatory Backup Tax Withholding?

Backup withholding is when 28% of payments made to you, are remitted directly to the IRS.

There are two main reasons why a person may be subject to mandatory backup tax withholding;

- You may be under mandatory backup tax withholding, if you owe back taxes to the IRS, and you’ll remain in withholding until the debt is paid in full.

- Your Social Security number and name don’t match IRS records.

If you know you don’t have tax debt, review your records and determine whether your where your identification number is incorrect on either the Form W-9 or the tax return. If there’s a mistake on your tax return, notify the IRS immediately and amend your return using Form 1040X.

Your Responsibilities as an Independent Contractor or Freelancer

As an independent contractor, you must take responsibility for the requirement to make estimated payments, due to the additional income. Each quarter you have the responsibility to make estimated payment based upon the additional tax liability, added to the overall tax liability, in that particular quarter. You would make estimated payment using Form 1040ES for that particular quarter. Failure you make estimated payment could subject you to penalties and interest.

Should I Hire a Tax Professional for Help?

We understand that receiving new unfamiliar tax forms can add to your stress. Our tax professionals can walk you through the process and answer any questions. With one of our tax professional by your side, you can rest assured that your taxes are in good hands. Whether you’re an individual who wants someone to prepare your taxes, or you’re self-employed and need a bookkeeper or Accountant, we offer a wide variety of financial services to keep you on track with your financial goals. Get a free consultation today by calling us today at 855-829-5877

Printable PDF