January 25, 2021

Where Do I Put 1098 T On My Taxes Return

Where Do I Put 1098 T On My Taxes Return

If you are a student who pays for your own education, or you are a guardian claiming a student as a dependent, you can expect to receive Form 1098-T. You might be familiar with tax documents like Form W-2, Form 1040, and Form 1099, if you recently paid education expenses, you’ll receive IRS Form 1098-T, Tuition Statement. Your tuition statement gives you details about the educational expenses and gives you the opportunity to obtain tax credits and deductions. Colleges and post-secondary educational institutions are required to send these to students each year.

What Is a 1098-T Form?

A 1098-T form is an IRS tax form that is known as the Tuition Statement. The tuition statement is issued by the Internal Revenue Service (IRS), and contains important information about your educational expenses. This form determines whether you are eligible for certain education-related tax deductions or tax credits.

How Do I Get My 1098-T Form?

If you or your student attends a college, university, or vocational school, you should receive Form 1098-T by January 31st to help file your taxes and keep in your records. Your school is required to send you a tuition statement each year you attend and have educations expenses.

Note: The

Does a 1098-T Increase My Refund?

Yes, a 1098-T can increase your refund. Depending on your tax obligations and other credits or deductions you take, you may qualify for a refund.

Either you or your parents can use the information provided on Form 1098-T to claim tax credits, like the American Opportunity Credit and Lifetime Learning Credit, which are subtracted from your total tax bill. You can use IRS Form 8863 to claim education credits for your federal income tax return. You should include Form 8863 with your Form 1040 when you submit your return to the IRS.

You can also take deductions for qualified education expenses under the Student Loan Interest Deduction. Deductions can help reduce your tax bill. You can claim the Student Loan Interest Deduction without having to itemize your deductions.

What Information Is Included on a 1098-T Form?

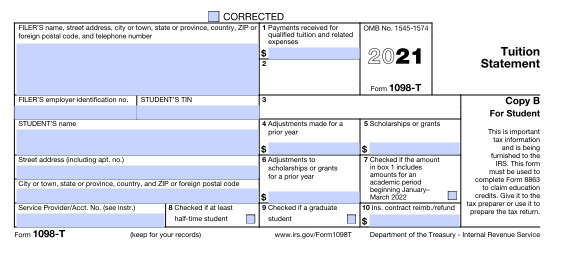

The tuition statement is only one page. The 1098-T contains ten lines that require the institution’s tax information as well as the student’s.

Here’s what you can expect to find when reviewing your 1098-T form:

- Box 1: Tuition payments billed and received.

- Box 2: No longer used, you will find that it’s grayed out.

- Box 3: No longer used, you will find that it’s grayed out.

- Box 4: Any adjustments made to the previous year’s Form 1098-T.

- Box 5: Any scholarships or grants provided to the student.

- Box 6: Any adjustments to scholarships or grants for the previous year.

- Box 7: The box is checked if any of the tuition paid during this tax year applies to the first quarter/semester of the following year.

- Box 8: The box is checked if the student is enrolled at least half-time.

- Box 9: The box is checked if the student is a graduate student.

- Box 10: Used by insurers who have issued any insurance contract refunds or reimbursements.

Qualified Educational Expenses on Form 1098-T

Qualified educational expenses include:

- Tuition

- Enrollment fees

- Course expenses that the student had to pay for their classes.

Even if a parent or guardian paid for these expenses, the student is still able to claim credit if the expenses are in their name and they are not claimed as a dependent.

Schools are required to report these qualified expenses to you and to the IRS. In previous years, schools could record your qualified expenses in two different ways:

- Some school’s base expenses on how much the student paid during the school year.

- Others determine expenses based on how much the school was billed.

However, for tax years 2019 and onward, school’s can only report based on how much the student paid during the school year, which will be found in Box 1.

While many of your school-related expenses are included in this category, not every expense receives a tax credit, including:

- Application fees.

- Processing fees.

- Money paid for courses involving extracurricular activities (unless it is part of a degree program or job skill training).

- Room and board.

- Insurance.

- Books and other course materials.

- Medical insurance.

- Transportation.

- Other personal costs.

While these expenses aren’t tax-deductible as education expenses, some as deductible as other potential types of deductions. If you are unsure of what you can and can’t claim, reach out to Legacy Tax & Resolution Services and one of our tax experts will help you decipher what can be claimed as an educational expense and what is eligible to be deduction elsewhere on your return.

What If I Received a Scholarship in the Past Year?

If you received a scholarship from the institution to help fund your education, your scholarship is typically considered a part of your gross income. Scholarships are generally tax-free if you are pursuing a degree and the awarded amount is used to pay for tuition, required fees, and materials. Any amount that is awarded as a stipend for living expenses like room and board is considered taxable.

To learn more about whether your scholarship is taxable, contact your institution’s finance department and consult a professional from Legacy Tax & Resolution Services to help maximize your tax deductions.

Do I Have to Put My 1098-T on My Tax Return?

No, you do not have to put the information from your 1098-T form on your tax return. However, it is to your benefit to claim education-related deductions or credits.

Keep in mind, only you or your parent (if you are being claimed as a dependent) may claim these expenses.

What If I Did not Receive Form 1098-T?

There are several reasons you may not have received your 1098-T Form, such as;

- You are a non-resident alien,

- Your school shut down part way through the year, or

- Your tuition and expenses were paid in full with grants and scholarships.

If you did not receive Form 1098-T, you can still claim education expenses on your tax return. You will want to submit provide documentation with the return as proof of expenses. Failing to do so will likely result in an IRS inquiry.

Can Legacy Tax Help Me with My Tax Form 1098-T?

Yes! One of our experts can walk you through Form 1098-T to help you understand how it works, what the different values mean, and how you can use this information to your advantage.

Our licensed tax advocates have help clients each year prepare their taxes and resolve tax issues. Whether you want to take advantage of tax deductions for your education expenses or you need to get out of tax debt, our professionals are standing by to help you right now.

Why Should I Choose Legacy?

We are proud to be a Better Business Bureau “A+” rated accredited company. Our experts are dedicated to finding simple, cost effective solutions to the tax problems of our clients. At Legacy Tax & Resolution Services, the client’s needs come first. We don’t charge outrageous upfront costs and we won’t charge you before you know your options. Call us today for a free consultation at (800) 829-7483 and get started on your future today.

Call us today for a free consultation. 1-800-829-7483

Printable PDF