IRS Notices - Audits

Index of IRS Audit Notices Letters and Forms Search by the IRS Notice, Form or Letter number in the box below

View pageIndex of IRS Audit Notices Letters and Forms Search by the IRS Notice, Form or Letter number in the box below

View pageIndex of IRS Collection Notices Letters and Forms Search by the IRS Notice, Form or Letter number in the box below

View pageIndex of IRS Return Errors Notices Letters and Forms Search by the IRS Notice, Form or Letter number in the box below

View pageIndex of IRS Unfiled Return Notices Letters and Forms Search by the IRS Notice, Form or Letter number in the box below

View pageIndex of IRS General Notices Letters and Forms Search by the IRS Notice, Form or Letter number in the box below

View page

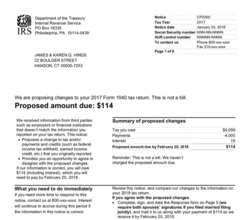

The IRS uses Notice CP23 to inform you of changes to your return because of an error in estimated tax payments and you have a balance due. At a minimum, review your payments to the IRS and see if you agree. The IRS may have misplaced or misdirected some of the payments. The CP 2000 is not a bill and nor an audit. It is a proposed adjustment due to a missing estimated payments. Sometimes the information supplied to the IRS is in error. Informs you of changes to your return because of an error in estimated tax payments and you have a balance due

View page

The IRS uses CP 16 to inform you of a change to your return based on a miscalculation or erroneous entry on your return. Often, this is because of information you provided or they received from third parties (Bank, Employer, or a Lender). The social security number may be incorrect on the return. If the notice states you will be receiving a greater refund, then no further response should be necessary as long as the explanation is correct. But, if the Notice indicates that you owe taxes or your refund was reduced, insure the explanation is correct. You need to reviews the items listed on the Notice CP 16 to determine if the items listed are in fact correct. CP 16’s are often wrong and the items are listed on the return. Sometimes the description of items is different enough to be picked up in the matching process. The CP 16 is not a bill and nor an audit. It is a proposed adjustment due to a miscalculation or missing items based on third party documents, supplied to the IRS. Sometimes the information supplied to the IRS is in error. Adjustment due to a miscalculation or missing items based on third party documents

View page

The IRS uses Notice CP 2000 (CP2000, IRS CP 2000) to inform you of proposed changes to your return based on information they have received from various third-party sources.

View page

The IRS uses Letter 1862 to inform you they have not received your federal tax return and they want you to file. You might receive this letter if you filed an extension but didn’t file a return. The IRS has not received your federal tax return and they want you to file

View pageIndex of IRS Other Notices Letters and Forms Search by the IRS Notice, Form or Letter number in the box below

View page

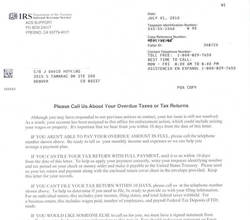

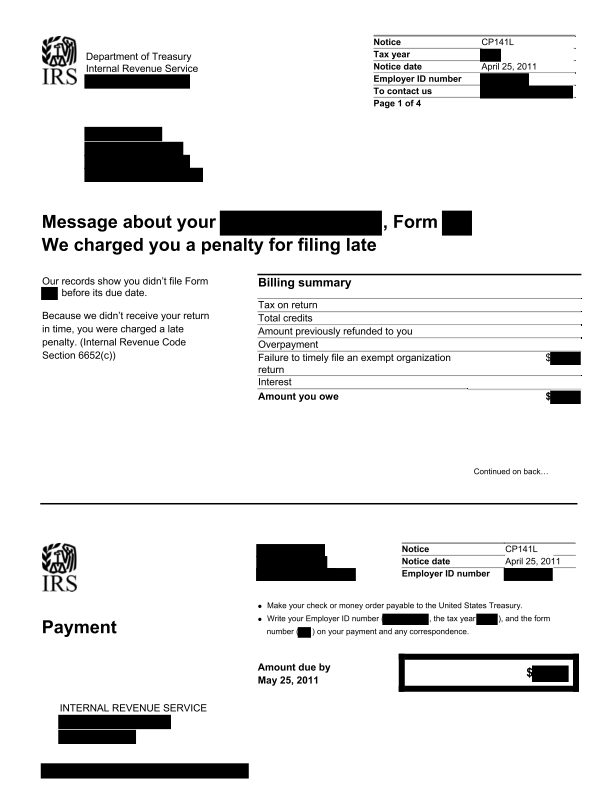

The IRS uses Notice CP161 to inform you of a balance due. Your situation is not yet urgent but should be corrected. The IRS will send gradually more hostile letters to you until they issue a Notice of Intent to Levy. If you are unable to pay the balance, you can set up an installment agreement. You will need to complete the Form 433B and disclose the business income/assets. I would suggest that you seek out representation regarding a business installment agreement. This can get really tricky! Notice of balance due IRS

View page

The IRS uses Letter 304C to inform you why they took certain action on your account. It often involves some misinformation or error on a document that was submitted to the IRS from a third party. It is important to review carefully what reasons the IRS gave for their determination or action. It will be important for you to contact IRS at 1-800-829-1040 to order your Account Transcripts and Wage & Income Transcripts and compare them with your return. Often, the company which issued the document to the IRS has made a mistake but they refuse or neglected to correct it. The IRS will not correct these issues, even if presented with proof. You must research the specific facts and present them to the issuer of the document. The issue must file the amended form to correct the issue. If the issuer refuses or is out of business, we have had success with an amendment of the return showing both the in and out of the item, with full documentation. This is a very trick amendment and you should not attempt it on your own. This is not a fool proof solution and sometimes only a Federal Court order will reverse the tax. IRS informing you why they took certain action on your account

View page

IRS uses Letter 4612C to ask you to send the missing form so they can process your return. You need to reviews the items listed on the Letter 4612Cto determine if the items listed are in fact correct. CP 22’s are often wrong and the items are listed on the return. Sometimes the description of items is different enough to be picked up in the matching process. The Letter 4612C is not a bill and nor an audit. It is a request for information due to issues with the return. Sometimes the information supplied to the IRS is in error. Send the missing form so they can process your return

View page

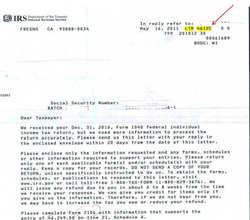

The IRS uses Letter 2050 to ask you to call them about your overdue taxes or past due taxes. If your case also involves unfiled returns, they have probably already sent a Final Notice of Intent to Levy. This means the IRS could levy against your assets or wages at any time. Your response to the IRS will have to be a quick determination of the basis for the tax, gathering of financial records and probably entering an installment agreement to avoid levies until a method for dealing with this problem can be devised. You must complete a Form 433A (if assigned to a Revenue Officer) or Form 433F (if assigned to Automated Collections Service) to disclose your income & assets to the IRS. Understand, the IRS will not will limit resolution options if you haven’t filed all legally required returns. Call the IRS about your overdue taxes or past due taxes

View page

The IRS uses Letter 2050 to ask you to call them about your overdue taxes or past due taxes. If your case also involves unfiled returns, they have probably already sent a Final Notice of Intent to Levy. This means the IRS could levy against your assets or wages at any time. Your response to the IRS will have to be a quick determination of the basis for the tax, gathering of financial records and probably entering an installment agreement to avoid levies until a method for dealing with this problem can be devised. You must complete a Form 433A (if assigned to a Revenue Officer) or Form 433F (if assigned to Automated Collections Service) to disclose your income & assets to the IRS. Understand, the IRS will not will limit resolution options if you haven’t filed all legally required returns. IRS Request for a Call

View page

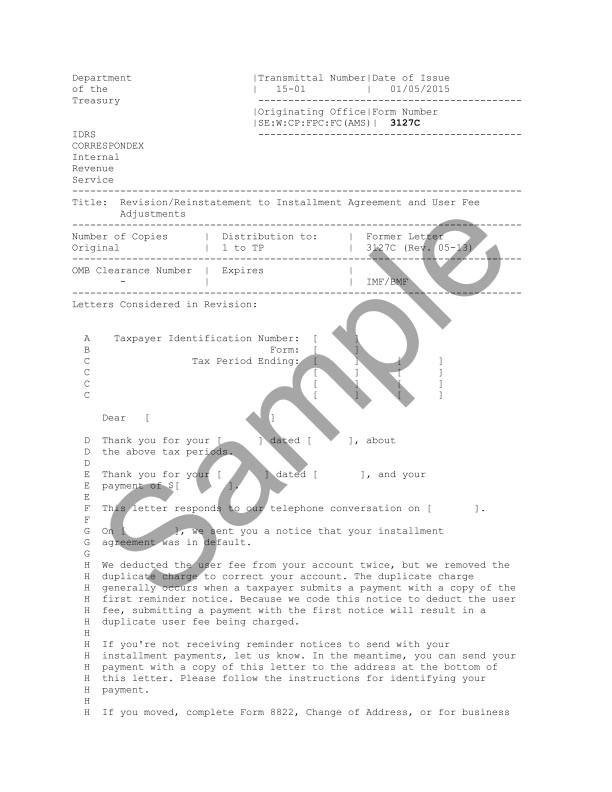

Letter 2273C is a general letter that usually explains some aspect of an installment agreement. It often explains the details of the payment agreement with instructions for where to send payments and the “set-up fee” charged by the IRS to initiate the agreement. You need to carefully follow the instructions. Note that even if your future payment will be Direct Debit Payment, the first payment will required to be made manually using a voucher that will be in the package. Explains the details of the payment agreement

View page

The IRS uses Letter 3228 to remind you of past due taxes. This notice indicates that seizure of your property is not imminent.. Your situation is not extremely urgent but is a constant reminder of the problem. The IRS uses Letter 3228 to remind you of past due taxes

View pageIndex of IRS Other Notices Letters and Forms Search by the IRS Notice, Form or Letter number in the box below

View page

Application for Withdrawal of Filed Form 668(Y)

View page

The IRS has over 16 versions of Letter 3164 which accompany other letters or notices about various IRS procedures being investigated. The essential message of Letter 3164 is that the IRS may contact 3rd parties for information about you.

View page

The IRS has over 16 versions of Letter 3164 which accompany other letters or notices about various IRS procedures being investigated. The essential message of Letter 3164 is that the IRS may contact 3rd parties for information about you.

View page

The IRS has over 16 versions of Letter 3164 which accompany other letters or notices about various IRS procedures being investigated. The essential message of Letter 3164 is that the IRS may contact 3rd parties for information about you.

View page

The IRS has over 16 versions of Letter 3164 which accompany other letters or notices about various IRS procedures being investigated. The essential message of Letter 3164 is that the IRS may contact 3rd parties for information about you.

View page

The IRS has over 16 versions of Letter 3164 which accompany other letters or notices about various IRS procedures being investigated. The essential message of Letter 3164 is that the IRS may contact 3rd parties for information about you.

View pageThe IRS has over 16 versions of Letter 3164 which accompany other letters or notices about various IRS procedures being investigated. The essential message of Letter 3164 is that the IRS may contact 3rd parties for information about you.

View page

The IRS has over 16 versions of Letter 3164 which accompany other letters or notices about various IRS procedures being investigated. The essential message of Letter 3164 is that the IRS may contact 3rd parties for information about you.

View page

The IRS has over 16 versions of Letter 3164 which accompany other letters or notices about various IRS procedures being investigated. The essential message of Letter 3164 is that the IRS may contact 3rd parties for information about you.

View page

The IRS has over 16 versions of Letter 3164 which accompany other letters or notices about various IRS procedures being investigated. The essential message of Letter 3164 is that the IRS may contact 3rd parties for information about you.

View page

The IRS has over 16 versions of Letter 3164 which accompany other letters or notices about various IRS procedures being investigated. The essential message of Letter 3164 is that the IRS may contact 3rd parties for information about you.

View page

The IRS has over 16 versions of Letter 3164 which accompany other letters or notices about various IRS procedures being investigated. The essential message of Letter 3164 is that the IRS may contact 3rd parties for information about you.

View page

The IRS has over 16 versions of Letter 3164 which accompany other letters or notices about various IRS procedures being investigated. The essential message of Letter 3164 is that the IRS may contact 3rd parties for information about you.

View page

The IRS has over 16 versions of Letter 3164 which accompany other letters or notices about various IRS procedures being investigated. The essential message of Letter 3164 is that the IRS may contact 3rd parties for information about you.

View page

The IRS has over 16 versions of Letter 3164 which accompany other letters or notices about various IRS procedures being investigated. The essential message of Letter 3164 is that the IRS may contact 3rd parties for information about you.

View page

The IRS uses Letter 11 (LTR11 or IRS LTR 11) as a FINAL Notice of Intent to Levy to inform you they intend to take your property and assets SOON. This is the FINAL notice before the IRS takes ACTION.

View page

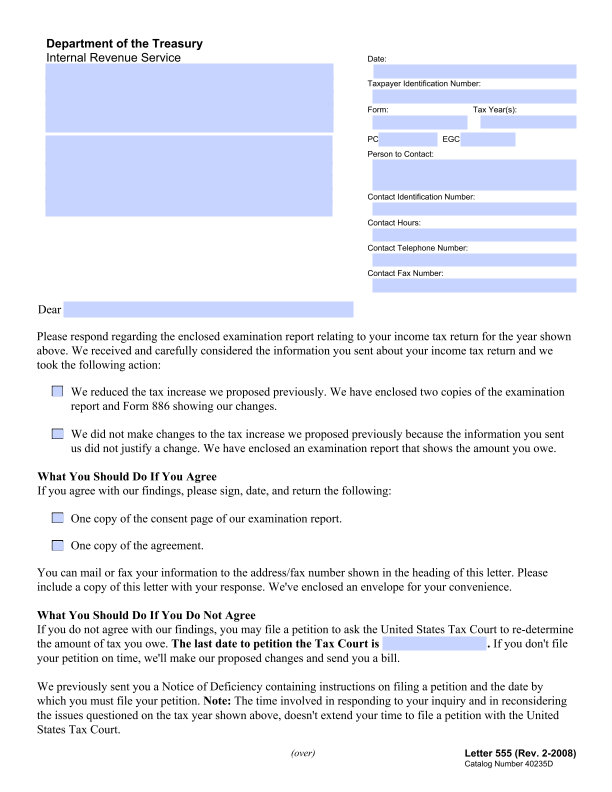

The IRS audited your tax return and the changes resulted in additional taxes owed. If you want to contest this determination you may petition the U.S. Tax Court.

View pageGlossary of Federal Notices

View pageGlossary of State Notices

View pageGlossary of California Notices

View pageGlossary of New York Notices

View page

IRS is Preparing to File a Substitute for Return If You Do Not Respond Within 10 Days

View page

The IRS uses Letter 2050 to ask you to call them about your overdue taxes or past due taxes. Before you call them, you need to be prepared for the phone call.

View page

IRS Letter 2975 is an URGENT notice to inform you the IRS intends to levy against your assets. It is very similar in effect to the CP523 for individuals. They are canceling your installment agreement and after 30 days they can seize business assets.

View page

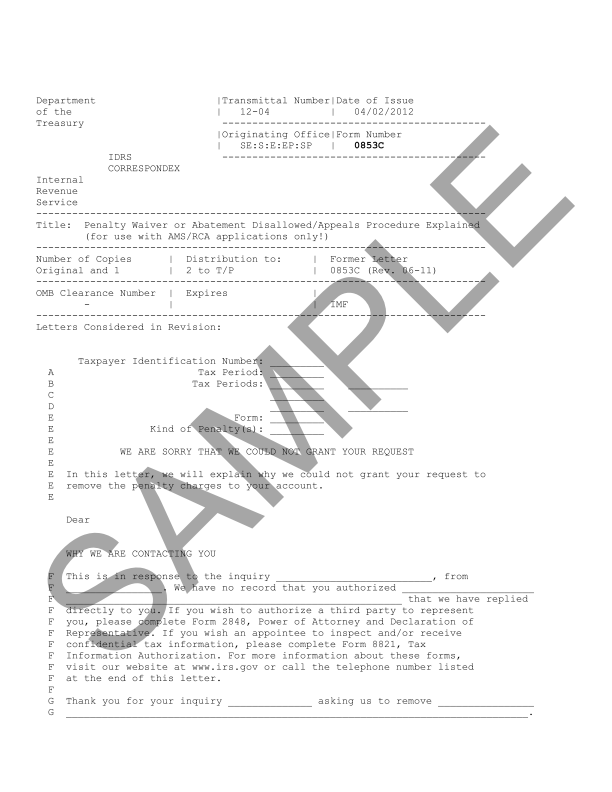

IRS uses Letter 854C to inform you that they have denied your Request for a penalty abatement. You have the right to appeal this denial. The IRS will explain the reason(s) why they believe they cannot remove the penalties.

View page

IRS uses Letter 853C to inform you that they have denied your Request for a penalty abatement. You have the right to appeal this denial. The IRS will explain the reason(s) why they believe they cannot remove the penalties.

View pageIRS uses Letter 3171 to inform you that they have filed additional Federal Tax Liens regarding an existing debt. This typically means they are filing in a different jurisdiction than the original Federal Tax Lien Filings. As with the original Federal Tax Lien filing, you have the right to appeal.

View page

IRS uses CP162 to inform you they assessed a penalty on behalf of your S Corporation. If you have had no "significant" penalty problems or late-filing within the last 3 years you may qualify for the "one-time" penalty abatement.

View page

IRS uses CP180 to inform you the IRS has reviewed your return and determined the tax return is missing a schedule or form. It is best to read the notice carefully and determine the required schedule or form and submit it to the IRS along with the completed contact information.

View page

IRS uses CP181 to inform you the IRS has reviewed your return and determined the tax return is missing a schedule or form. It is best to read the notice carefully and determine the required schedule or form and submit it to the IRS along with the completed contact information.

View page

IRS uses CP14I to inform you the IRS believe you have exceeded the maximum contribution to your ROTH IRA for the year.

View page

IRS uses CP21E to inform you the IRS reviewed your tax return and made changes that resulted in an amount due. The CP21E explains the changes made

View page

IRS uses CP22E to inform you the IRS reviewed your tax return and made changes that resulted in an amount due. The CP21E explains the changes made

View page

IRS uses CP22I to inform you the IRS reviewed your tax return and made changes that resulted in an amount due. The CP21E explains the changes made

View page

IRS uses CP3219A to inform you that after the IRS processed your return, additional information was received from third-parties. The IRS sent you one or more notices requesting that you verify the new information and never received a response.

View page

IRS uses CP3219B to inform a business that after the IRS processed the business return, additional information was received from third-parties. The IRS sent the business one or more notices requesting that the business verify the new information and never received a response.

View page

IRS uses CP3219N to inform you that the IRS has received income information from third-parties that would indicate that you need to file. The IRS sent you one or more notices requesting that you file a return and never received a response.

View page

IRS uses CP42 to inform you that IRS has taken your refund to be applied to your spouse's or ex-spouse's other tax debt. If your refund was taken to pay an ex-spouse's tax debt, your tactic will depend on how cooperative your ex-spouse is.

View page

IRS uses CP71 to reminder you while in a Currently Not Collectible status that your penalties and interest continue to accrue. Although a payment is not required currently, the notice gives a date you should pay by if you want to keep additional penalties and interest from accumulating.

View page

IRS uses Letter 3573 as a confirmation for an audit examination appointment.

View page

IRS uses Letter 5036 as a request to verify income reported to the IRS by credit card merchants. The IRS thinks that your tax return shows an unusually high portion of gross receipts attributable to credit card payments.

View page

IRS uses Letter 5036 as a request to verify income reported to the IRS by credit card merchants. The IRS thinks that your tax return shows an unusually high portion of gross receipts attributable to credit card payments.

View pageIRS uses Letter 5035 as a request to verify income reported to the IRS by credit card merchants. The IRS thinks that your tax return shows an unusually high portion of gross receipts attributable to credit card payments.

View page

IRS uses CP19 to inform you that a credit or deduction was not allowed on your return and as a result of the changes, you now have a balance due. You likely received CP-18 notifying you that part of the expected refund was being withheld, pending further review.

View pageIRS uses CP20 to inform you that the IRS has reviewed your return and disallowed a credit or deduction. As a result of the changes, you now have a refund due. You likely received CP-18 notifying you that part of the expected refund was being withheld, pending further review.

View pageIRS sends out CP2100 Notices twice a year, in October and the following April. The notices let payers know they may be responsible for backup withholding when TINs are missing from IRS records or have incorrect name/TIN combinations.

View pageIRS sends out CP2100A Notices twice a year, in October and the following April. The notices let payers know they may be responsible for backup withholding when TINs are missing from IRS records or have incorrect name/TIN combinations.

View page

IRS sends out CP259 when they do not receive a business tax return by the due date and the IRS believes that you are required to file a return. If you believe you filed the return, resend them a copy.

View pageIRS sends out CP58 when you filed status Married Filing Jointly or Married Filing Separate. The spouse's social security number is missing, illegible or invalid. CP58 was sent to notify taxpayer of the problem and how to resolve it.

View page

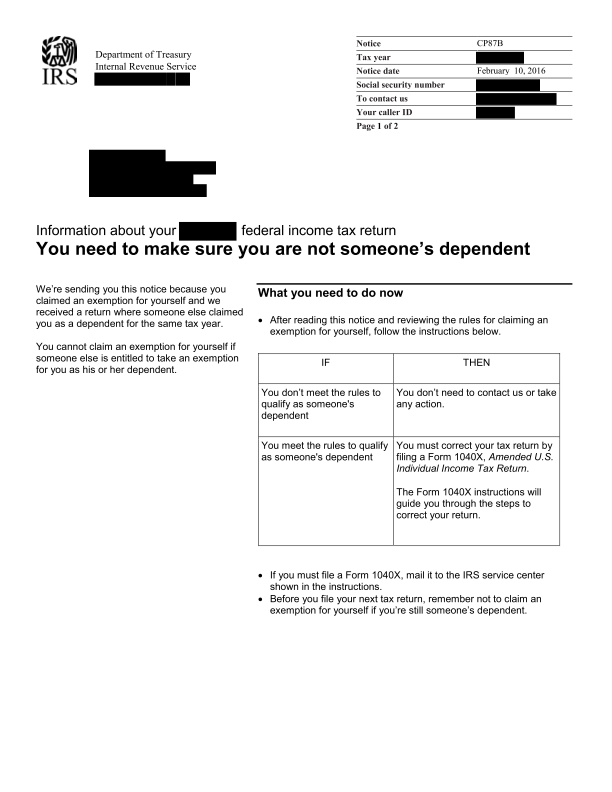

IRS sends out CP87B when you filed a return claiming yourself as an exemption and on another return, you were claimed as a dependent. You need to clarify whether someone else is entitled to claim you on their tax return.

View pageIRS sends out CP87C when you filed a return claiming one or more dependents. The dependent you claimed filed their own return, claiming their own exemption.

View pageIRS sends out CP87D when you filed a return claiming one or more dependents. One of your dependents filed a joint return with their spouse. You may not be eligible to claim this individual, so the IRS wants you to verify that the dependent meets the rules to qualify as your dependent.

View pageIRS sends out Form 14420 to verify your income, typically as a result of Letter 5035, Letter 3036 or Letter 5039. Basically, the IRS is matched the information reported on Form 1099-Ks that were sent to the business with income reported on the tax return.

View page

IRS sends out Letter 131C when the IRS is requesting additional information. This a rather curious letter, it starts with; “We would like to answer your question, but we need more information”.

View pageIRS Appeals sends out Letter 1363 to inform the taxpayer of a partial disallowance of a refund claim. The letter is sent by certified letter. The appeals office will detail the reason for the partial disallowance.

View pageIRS Appeals sends out Letter 1364 to inform the taxpayer of a full disallowance of a refund claim. The letter is sent by certified letter. The appeals office will detail the reason for the full disallowance.

View pageIRS Appeals sends out Letter 3338C to inform you that your return was selected for an audit, you failed to timely respond to the audit notice. Due to the lack of response, the IRS issue an audit determination and additional taxes were assessed.

View page

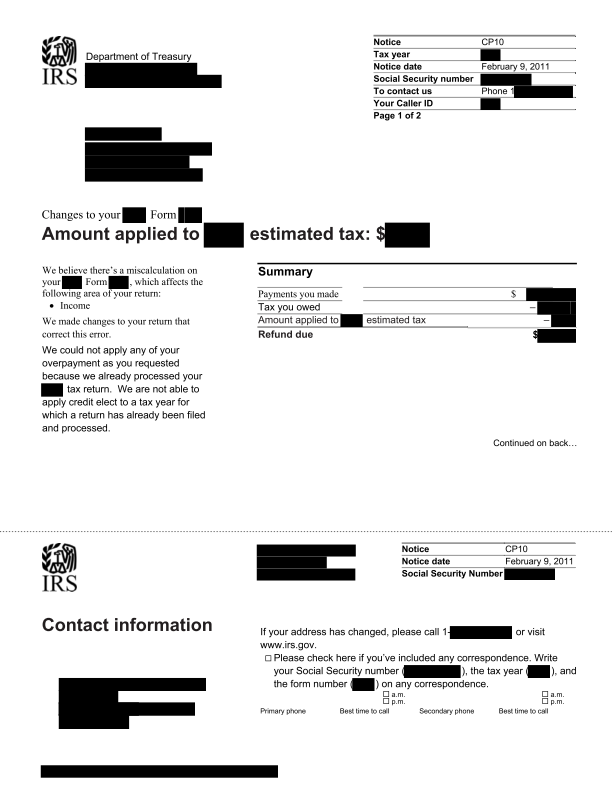

IRS uses CP 10 when the tax due was calculated incorrectly on your tax return and the correction to the calculation has reduced the refund amount that was designed to be applied to the next year’s tax return.

View page

IRS uses Letter 5043 when the IRS needs verification of the income that was reported to the IRS by credit card merchants and/or third-party networks on Form 1099-K.

View page

IRS uses Letter 3219 to inform you of a Notice of Deficiency because you were audit and you did not agree with the changes in the Form 4549.

View pageIRS uses Letter 950 to inform that they have concluded their audit. As a result of the audit taxpayer liability was either increased or decreased. The IRS will explain their findings and discuss your appeal rights.

View page

IRS uses CP 215 to inform that a civil penalty has been charged against your business because failed to file a return, accurately report income information to the IRS or pay employment taxes.

View pageIRS uses CP 406 to inform That you have not filed Form 5500 for a particular plan year and the IRS records indicate the plan is still active.

View page

IRS uses CP508C to inform the State Department that you Federal Tax Debt is above $50,000 and the IRS has sent several notices in an attempt to receive payment. The IRS has filed a Notice of Federal Tax Lien and/or issued a levy against your wages or bank account.

View pageIRS uses CP264 to inform of the denial of an S Corporation election. You do not have to do anything unless you wish to have Form 2553 (S Corp Election) approved. If so, you will need to file a new Form 2553 meeting all requirements.

View page

IRS uses Letter 2194 to inform that the IRS believe you owe Alternative Minimum Taxes.

View page

IRS uses Letter 2267C to inform that you have past due taxes that must be filed.

View page

IRS uses CP 134R to inform that there is a discrepancy between the federal tax deposits received by the IRS and what was reported on your return. This resulted in a refund.

View pageIRS uses CP 136B to inform you that your federal tax deposits requirements have changed. Last year you filed Form 944 (Employer's Annual Federal Tax Return) and the IRS has determined that in the upcoming calendar year, you must file Form 941 (Employer's Quarterly Federal Tax Return).

View page

IRS uses CP90C to inform you that has issued a levy for assets due to an unpaid balance. You have the right to a collection due process hearing and should file Form 12153, Request for a Collection Due Process or Equivalency Hearing.

View pageIRS uses Letter 907 to request an extension of the assessment statute. This time can be extended is the taxpayer agrees on Form 872, Consent to Extend the Time to Assess Tax, or Form SS 10, Consent to Extend the Time to Assess Employment Taxes.

View page

IRS uses LT 14 to request that you contact the IRS within 7 days to discuss the past due tax balance.

View page

IRS uses Letter 16 to notify you that you have a balance due and your account has been marked for enforcement action.

View page

IRS uses CP141I to notify you have filed an incomplete return. The IRS will indicate what is missing from the return.

View pageIRS uses CP240 to notify you that the IRS has adjusted your employment tax account. This is as a result in difference between your employment tax return and figures provided by W-2, W-2G and 1099R forms.

View page

Form 4669 is required when an employer does not withhold the required withholding tax from an employee/contractor, is later audited, and wishes to apply for relief under IRC 3402(d).

View page

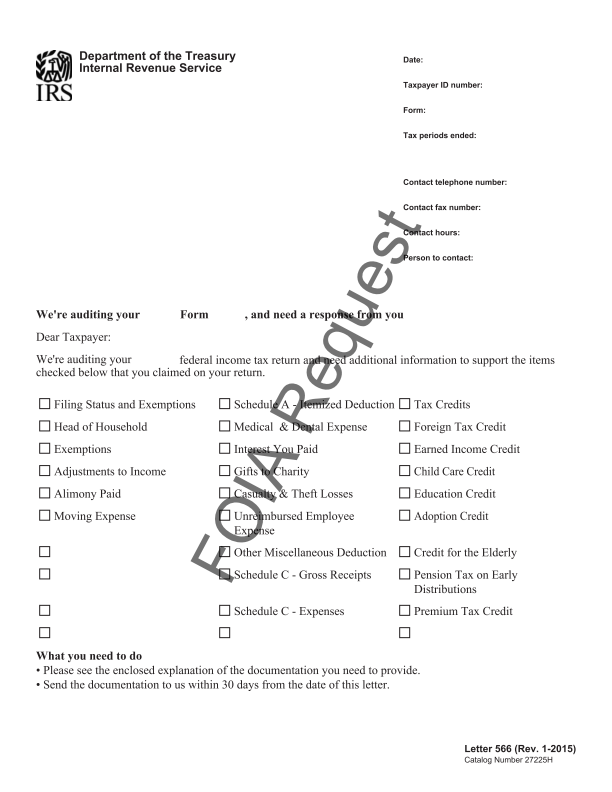

IRS uses Letter 566 to notify you that your return has been selected for audit and you have been requested to provide documents to prove you are eligible to take one or more deductions or credits.

View page

IRS uses CP79 to notify you that your request for the one or all of the following was denied.

View page

IRS uses CP79A to notify you that the IRS has disallowed the Earned Income Tax Credit claimed on your return for “reckless or intentional disregard” for the Earned Income Tax Credit rules and regulations.

View page

IRS uses CP180 to notify that you have filed an incomplete return. The IRS will indicate what is missing from the return.

View pageIRS uses CP181 to notify you that you have filed an incomplete return. The IRS will indicate what is missing from the return.

View pageIRS uses CP174 to notify you your tax return filing requirement may have changed. You may no longer owe excise taxes. The IRS needs an explanation of the exempt payments listed on the return.

View page

IRS uses CP178 to notify you a final excise tax return may need to be filed. You may no longer owe excise taxes. For the last four quarter you indicated on Form 720 Quarterly Federal Excise Tax Return that no excise tax was due.

View page

IRS uses CP169 to notify you the IRS cannot locate a return that you indicated was previously filed.

View page

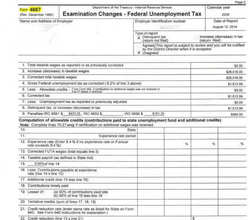

IRS uses Form 4667 to notify you the IRS of one of the following; A federal unemployment tax return audit An amended federal unemployment tax return review Taxes assessed for a federal unemployment tax return that was not filed as required.

View page

IRS uses Form 4668 to notify you the IRS.

View page

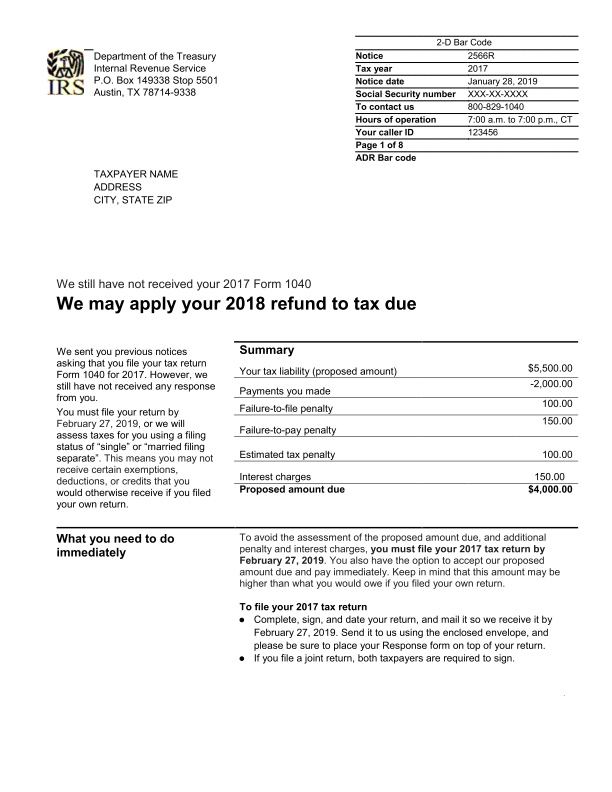

IRS uses CP2566R to notify you that the IRS calculated your tax, penalties, and interest on the outstanding return(s). The IRS previously sent you CP63 informing you that they were holding your refund pending one or more returns.

View page

IRS uses Letter 5972C to notify you that they trying to collect a debt or unfiled returns from you.

View page

IRS uses CP267 to notify you that the amount of credits (federal tax deposits or estimated payments) you claimed on your tax return for the tax period shown on your notice and the amount of credits that were applied to that year are different.

View page

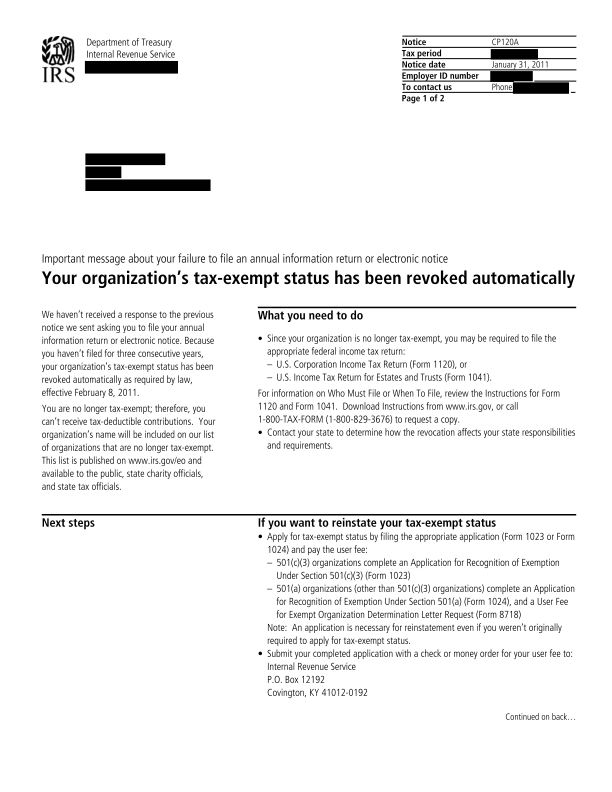

IRS uses CP120A to notify you that your organization's tax-exempt status has been revoked for failure to file a Form 990 series return for three consecutive years.

View page

IRS uses CP207 to notify you that your deposit schedule, the Record of Federal Tax Liability (ROFTL), had missing or incorrect information. The IRS needs additional information from you.

View pageIRS uses CP45 to notify you they were unable to apply your overpayment to your estimated tax as you requested.

View page

IRS uses CP81 to notify you they have not received your return and the refund statute is about to expire. The IRS believes that you will receive a refund if a return is filed timely.

View page

IRS uses Letter 2469C to notify you they have not received your return and the refund statute is about to expire. The IRS believes that you will receive a refund if a return is filed timely.

View pageIRS uses Letter 852C to notify you your request for a penalty waiver or abatement was denied.

View pageIRS uses Letter 916C to notify you your tax return, claim or request is incomplete and cannot be processed.

View page

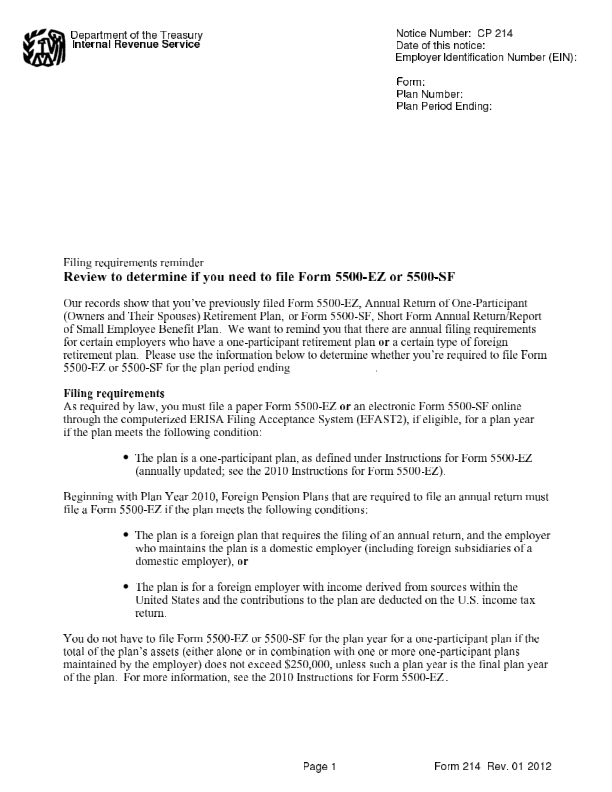

IRS uses CP214 as a reminder notice for Employee Plans filers who previously filed a Form 5500-EZ or Form 5500-SF.

View pageIRS uses CP07 to notify you the IRS received your tax return and are holding your refund until the IRS completes a more thorough review of the benefits you claimed under a treaty and/or the deductions claimed on Schedule A.

View page

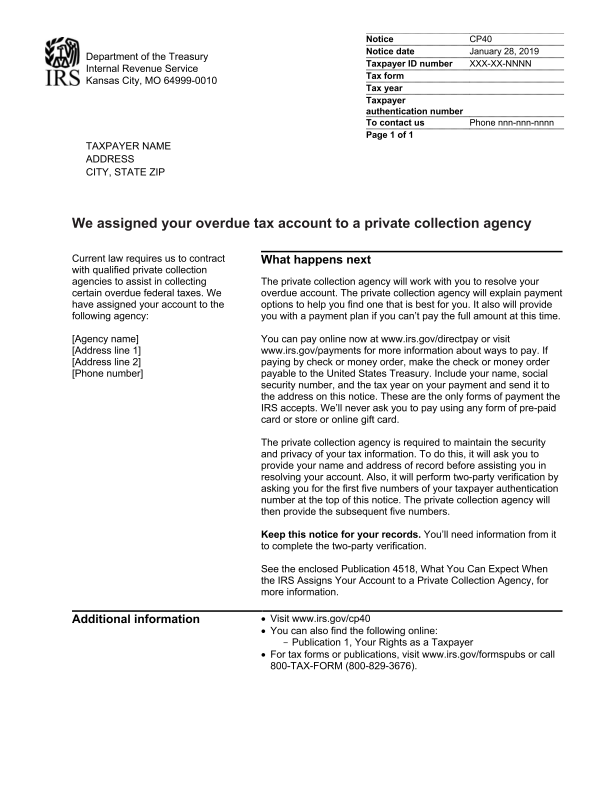

While IRS Notice CP 40 is not good news, it is not necessarily bad either. If you receive CP40 IRS Notice, it should not be taken lightly.

View page

IRS uses CP44 to notify you the IRS is delaying your refund until they have determined whether you owe other taxes.

View pageIRS uses CP515B as a reminder that a business tax return has not been received for the tax year/period shown on the notice. A previous notice has been sent to the taxpayer requesting the return, but no response was received.

View pageIRS uses CP288c when they are holding on to a taxpayer’s refund until other tax returns are filed. The IRS only does this when they believe the other returns will have taxes owed.

View page

IRS uses Letter 39 (LT 39) to notify you a refund on your current year tax return was applied to the balance due on another tax year. You are still responsible for the remaining balance due for that tax year.

View page

IRS uses Letter 3016 to notify you the IRS has made a preliminary decision in your Innocent Spouse case.

View page

IRS uses Letter 555-T to notify you the IRS has received the taxpayer's response to a Notice of Deficiency and has made a decision based on the information received.

View page

IRS uses Letter 4464C to notify you your return is under review as part of the normal revenue protection program.

View pageIRS uses Letter 4987C to recognize that you filed an innocent spouse request as the requesting spouse (RS). This request was seeking relief from joint and several liability or relief from application of community property laws, also known as innocent spouse relief.

View pageIRS uses Letter 4988C to recognize that you filed an innocent spouse request as the requesting spouse (RS). The notice 4988-C advises the taxpayer that the claim was fully denied because the requesting spouse did not meet all the qualifications for granting innocent spouse relief.

View page

RS uses Letter 2625C to request additional information to clarify W-2 or 1099 income for an employee/payee.

View pageIRS uses Letter 99C to notify you of a discrepancy between amounts reported on your employment tax returns and amounts reported on information returns.

View pageIRS uses Letter 3457 to notify you as the partner of a partnership that the partnership return is being audited.

View pageIRS uses Letter 3897 to notify you to request that you complete Form SS-8 Determination of Workers Status for the Purpose of Federal Employment Taxes and Income Tax Withholding, for one or more of the worker names listed on the notice.

View page

IRS uses CP57 to notify you the bank failed to honor a draft from your account.

View pageIRS uses CP75A to notify you the IRS is auditing your tax return and needs documentation to verify the Earned Income Credit (EIC), dependents and filing status you claimed.

View page

IRS uses Letter 2202 to notify you your return was selected for audit and the IRS auditor wishes to confirm your initial audit appointment.

View pageIRS uses LP59 to notify you that your employer has not responded to the IRS’ Notice of Levy. The letter explains the penalties which may be assessed for failure to comply with the levy.

View pageIRS uses CP215 to notify you that a civil penalty has been charged and explains the reasons for the penalty.

View pageIRS uses Letter 2804C to notify your penalty abatement for providing inaccurate information on a Form W-4 has been denied.

View pageIRS uses Notice 972CH to notify an employer of a proposed penalty for filing ACA Forms 1094/1095 late, or filing on incorrect media, or filing with incorrect TIN/Name under IRC 6721.

View pageIRS uses Audit Field to notify you of an IRS field audit. An IRS Field Audit is the most detailed kind of IRS audit. In a field audit, an IRS representative will come to the taxpayer’s home or place of business to examine records.

View pageIRS uses Audit Office to notify you of an IRS Office Audit. In an office audit, the taxpayer is expected to arrive at their local IRS office for an in-person meeting with an IRS examiner.

View pageIRS uses Audit Correspondence to notify you of an IRS Correspondence Audit. A correspondence audit is conducted by mail and is the most common type of IRS audit.

View pageIRS uses Letter 3851B to notify you that you filed an employment tax return that has been selected for audit.

View pageIRS uses CP01B to notify you that the IRS received your federal income tax return and needs more information to process it accurately.

View pageIRS uses CP01H to notify you when the IRS receives a tax return that contains a social security number (SSN) for an account that we locked because our records indicate the TIN belongs to an individual who died prior to the tax year of the return submitted.

View page

IRS uses CP14H to notify you that you have an unpaid balance on a Shared Responsibility Payment (SRP).

View pageIRS uses CP10A to notify you the IRS found a miscalculation involving their Earned Income Credit. This miscalculation affected the amount of taxpayer's refund which was applied to estimated taxes for next year.

View page

IRS uses CP11A to notify you the IRS found a miscalculation involving their Earned Income Credit. This miscalculation results in an additional tax balance due.

View pageIRS uses CP12A to notify you the IRS found a miscalculation involving their Earned Income Credit. This error resulted in a refund or a larger refund amount.

View pageIRS uses Letter 565 to acknowledge receipt of documents and request additional documents. You must respond within 30 days by providing the additional documents requested.

View pageIRS uses Letter 569 to notify you after an audit that your request for a refund or credit is being partially or fully denied.

View pageIRS uses LP 61 to notify you have an employee with a federal tax matter. The IRS is requesting the information in the response form for the individual named in the notice.

View pageIRS uses Letter 3540A to notify you they are proposing to add alimony income and providing you an opportunity dispute the amount.

View pageIRS uses CP 425 to notify you that your exempt organization has a Form 990 filing requirement. The IRS did not receive Form 990 for the year specified. Previously, your exempt organization was sent CP259A as a 1st request.

View pageIRS uses CP 427 to notify you that your presumptive private foundation, or non-exempt charitable trust treated as a private foundation has a presumptive Form 990-PF (Return of Private Foundation) filing requirement.

View pageIRS uses CP 428 to notify you that your exempt organization has a Form 990-T filing requirement. The IRS did not receive Form 990-T for the year specified. Previously, your exempt organization was sent CP259D as a 1st request.

View pageIRS uses CP 426 to notify you that your private foundation, or non-exempt charitable trust treated as a private foundation has a presumptive Form 990-PF (Return of Private Foundation) filing requirement. The IRS did not receive Presumptive Form 990-PF for the year specified.

View pageIRS uses CP 430 to notify you that your political organization, or exempt organization has a Form 1120-POL (U.S. Tax Return for Certain Political Organizations) filing requirement. The IRS did not receive Form 1120-POL for the year specified.

View page

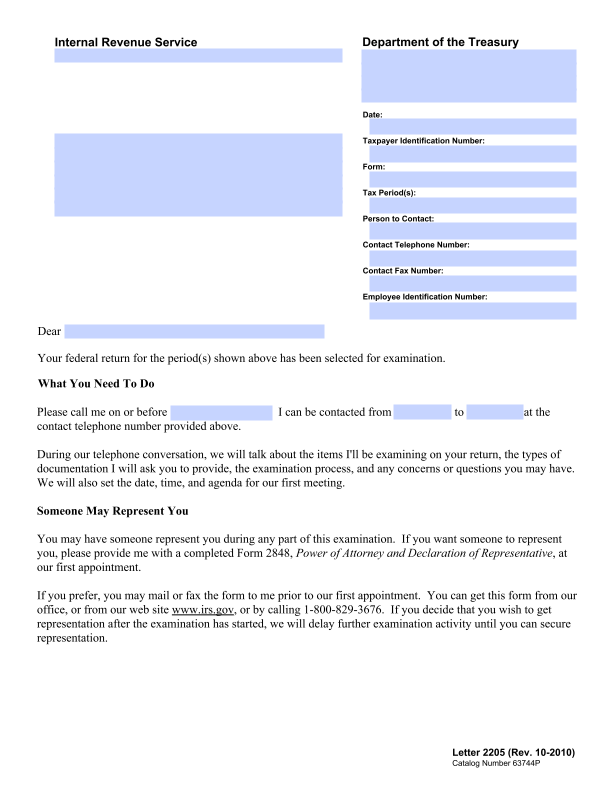

IRS uses Letter 2205 to notify you that your return has been selected for audit. The notice will likely include Form 4564 or Form 886-A to indicate what is being requested and what areas of the return are being audited.

View page

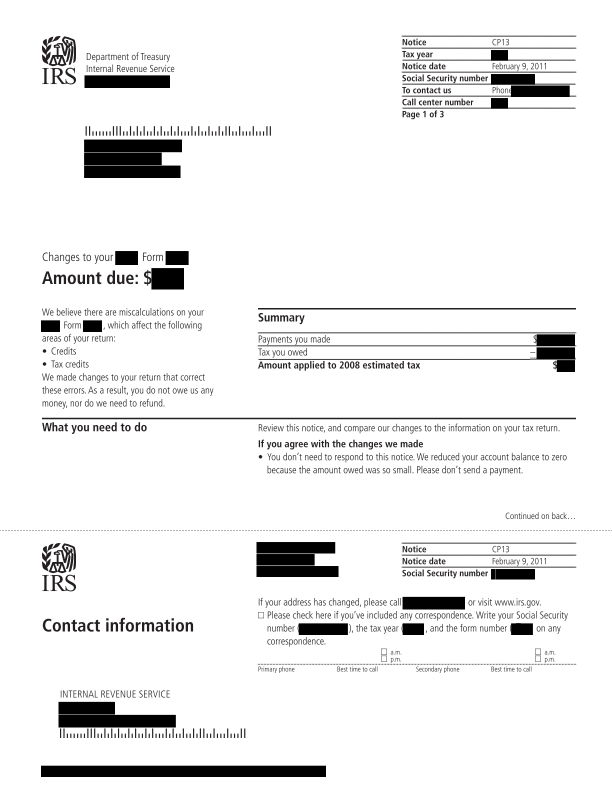

IRS uses CP13 to notify you that the IRS made changes to your original return due to an error. The change(s) resulted in a zero balance.

View page

IRS uses CP13A to notify you that the IRS made changes to your original return due to an error with the Earned Income Credit. The change(s) resulted in a zero balance.

View page

IRS uses CP105 to notify you that the IRS made changes to your original return due to a math error. The change(s) resulted in a balance due.

View page

IRS uses CP106 to notify you that the IRS made changes to your original return due to a math error. The change(s) resulted in a balance due.

View pageIRS uses CP83 to notify you that the IRS requested but has not received adequate documentation regarding a math error. The IRS is requesting that the taxpayer agree to a reassessment of tax and is forwarding the case to examination for final resolution.

View pageIRS uses CP55 to notify you that a department within the IRS requested a copy of a tax form from its Files Management Function. Because the return was 10 years or older, it was destroyed due to age.

View pageIRS uses CP268 to notify you that the IRS made changes to your original return due to an error. The change(s) resulted in an overpayment credit.

View pageIRS uses CP167 to notify you that the obtained information from taxpayer's state that differed from the information shown on the Federal return. The IRS sent CP167 to notify taxpayer of the increase in FUTA tax.

View pageIRS uses CP168 to notify you that the obtained information from taxpayer's state that differed from the information shown on the Federal return. The IRS sent CP168 to notify taxpayer of the decrease in FUTA tax.

View page

IRS uses CP15H to notify you that the IRS is charged a Shared Responsibility Payment Penalty because you did not maintain minimum essential health coverage.

View pageIRS uses CP213N to notify you that the IRS is proposing a penalty due to the late filing of a Form 5500, 5500-SF or 5500-EZ.

View pageIRS uses Letter 369C to inform of or explain the penalty for underpayment of estimated payments

View pageIRS uses Letter 2811C to inform you your request for penalty abatement for providing inaccurate information on a Form W-4 has been accepted

View pageIRS uses CP213I to notify you that the IRS is proposing a penalty due to the late and/or filing of a Form 5500, 55-SF or 5500-EZ.

View page

IRS uses CP75 to notify you that the IRS is examining your return due to problems with the Additional Child Tax Credit (ACTC), Earned Income Credit (EIC), and/or the Premium Tax Credit (PTC).

View page

IRS uses CP75B to notify you that the IRS is examining your return due to problems with the Earned Income Credit (EIC).

View page

IRS uses CP75D to notify you that the IRS is examining your return with respect to dependents claimed for filing status, Earned Income Credit, Child Tax Credit, and/or American Opportunity Credit.

View pageIRS uses CP429 to notify you that your Charitable Remainder Trust has a Form 5227 (Split-Interest Trust Information Return) filing requirement for the tax year shown on the notice.

View pageIRS uses CP209 to notify you that you requested an Employer Identification Number (EIN) and the IRS inadvertently assigned more than one EIN to you.

View page

IRS uses CP289 to notify you that you filed a business return that resulted in a balance due. You entered into an Installment Agreement to pay the tax liability.

View page

IRS uses CP521 to notify you that you filed a individual return or the IRS prepared a return on your behalf, that resulted in a balance due.

View page

IRS uses CP523H to notify you that you have a balance due from an unpaid Shared Responsibility Payment (SRP) penalty. You contacted the IRS to establish a payment agreement for that penalty.

View page

IRS uses CP89 to notify you that you filed an individual return, or the IRS prepared a return on your behalf, that resulted in a balance due. You entered into an Installment Agreement to pay the tax liability.

View page

IRS uses Letter to notify you that your Installment Agreement has been changed or reinstated as requested

View pageIRS uses CP508R to notify you that the IRS has reversed the certification of the taxpayer’s tax debt as seriously delinquent with the State Department.

View pageIRS uses CP508R to notify you that the IRS has reversed the certification of the taxpayer’s tax debt as seriously delinquent with the State Department.

View pageIRS uses CP130 to notify you because they filed a corporate income tax return and included Form 4626 (Alternative Minimum Tax - Corporations).

View pageIRS uses CP130 to notify you because they filed a corporate income tax return and included Form 4626 (Alternative Minimum Tax - Corporations).

View pageIRS uses CP157 to notify you because your company filed a corporate tax return which included a refundable credit for prior year minimum tax on Form 8827.

View pageIRS uses CP136B to notify you because you filed Form 944 (Employer's Annual Federal Tax Return) last year and the IRS has determined that in the upcoming calendar year, you must file Form 941 (Employer's Quarterly Federal Tax Return).

View pageIRS uses CP569 to notify you of one of two issues: Taxpayer's application for an individual taxpayer identification number (ITIN) was rejected, or Taxpayer requested a detailed penalty computation.

View pageIRS uses Letter 556B to notify you of that you have a tax return that has been selected for audit. This notice will inform you of the areas the IRS has selected for audit and request documentation to substantiate the information on the return.

View pageIRS uses Letter 3228 to remind you of a balance due and remind you the IRS has not received payment or other information regarding this balance.

View pageIRS uses CP107 to notify you that you filed Form 1042, Annual Withholding Tax Return for U.S. Source Income of Foreign Persons. The IRS found a math error when processing the return.

View page

IRS uses CP163 to notify you that you have an outstanding balance due.

View page

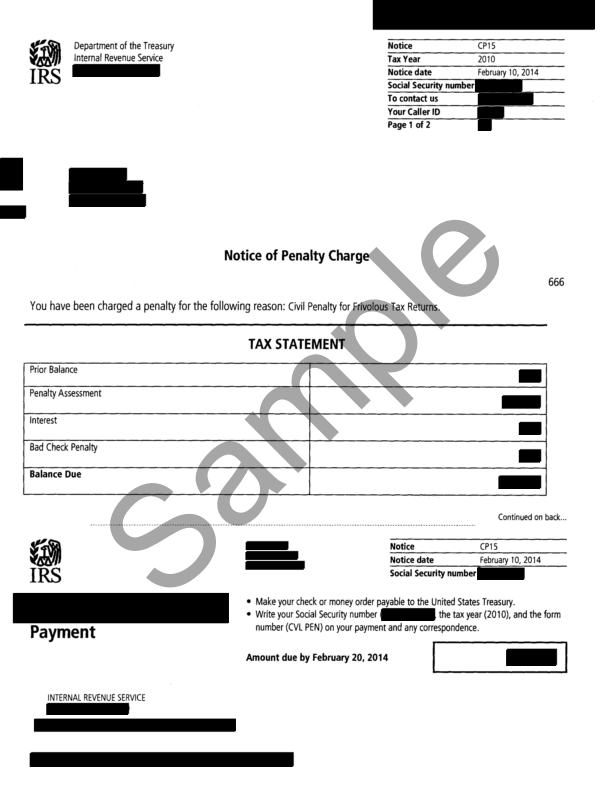

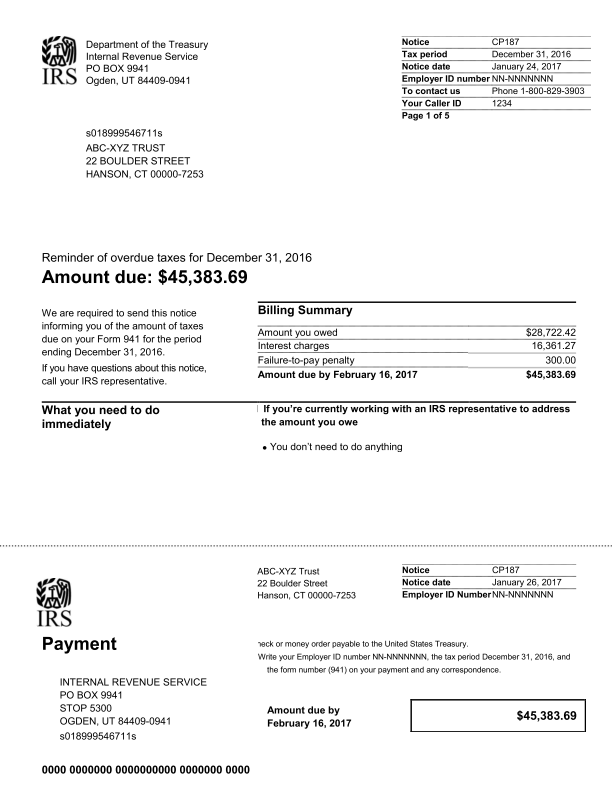

IRS uses CP187 to notify you that your business has an outstanding balance due.

View pageIRS uses CP314 to notify you that you have an outstanding balance due. Previously, your client filed Form 5329 (Additional Taxes on Qualified Plans (including IRAs) and Other Tax Favored Accounts) but did not pay the IRA taxes due.

View pageIRS uses Letter 2257C to notify you that you have an outstanding balance due. You received this notice in response to their oral or written request for a payoff amount for any balance due account with the IRS.

View pageIRS uses Letter 3220 to notify you that you made a payment towards a tax liability, but there is still a balance due. This notice requests payment of the remaining liability.

View page

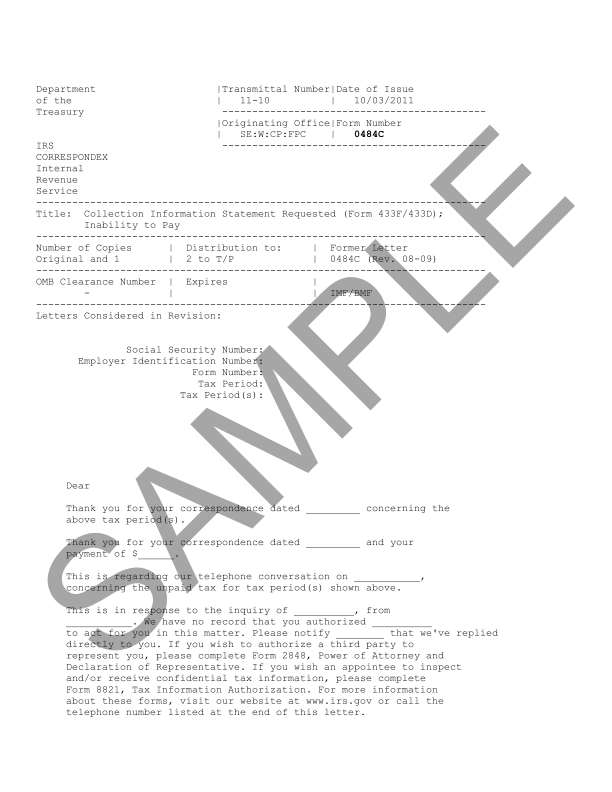

IRS uses Letter 484C to notify you because you previously contacted the IRS and indicated an inability to pay a tax liability.

View pageIRS uses Letter 4000 to notify you of the final opportunity to present information in a Collection Due Process (CDP) hearing.

View page

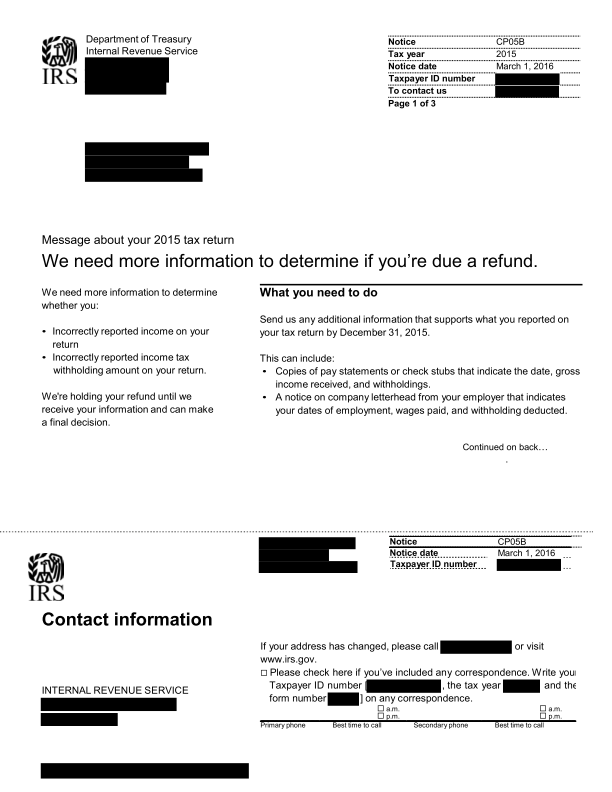

IRS uses CP05B to notify you because the information reported by third parties conflicts with the W-2, W-2G, or 1099-R income or federal withholding reported on the return.

View pageIRS uses Form 4670 for Relief from Payment of Income Tax Withholding) is required when an employer does not withhold the required withholding tax from an employee/contractor, is later audited, and wishes to apply for relief under IRC Section 3402(d).

View page

IRS uses Letter 1615 to notify you that you have a past-due tax return. Previously, the IRS contacted the taxpayer to request the unfiled tax return, but no response was received.

View page

IRS uses CP219 to notify that the IRS received your Form 940, Federal Unemployment Tax; however, you are not required to file.

View page

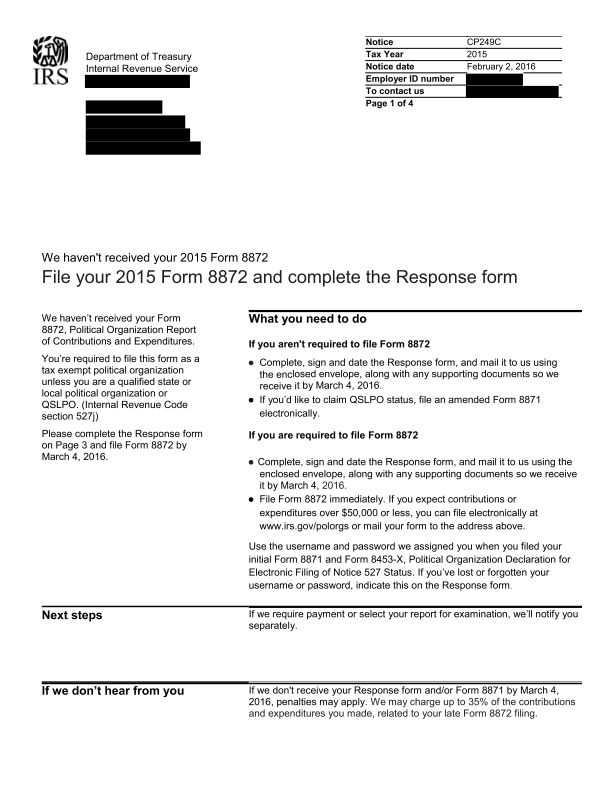

IRS uses CP219 to notify that the IRS did not receive your Form 8872, Political Organization Report of Contributions and Expenditures, for the period on the notice.

View page

IRS uses CP112 to notify the IRS made one or more changes to your client's Form 941, 941-SS, 943, 944 or 945 which resulted in an overpayment.

View pageIRS uses Letter 3853C to notify you because an incomplete or erroneous business income tax return (Form 1120 U.S. Corporation Income Tax Return or Form 1120S U.S. Income Tax Return for an S Corporation) was filed.

View page

IRS uses CP108 to notify that you made a federal tax deposit, and it was not clear which form and/or tax period to apply it to.

View page

IRS uses CP05A to notify that the IRS needs additional information to complete the review of their return.

View page

IRS uses Letter 1802C to notify that the because the Automated Underreporter Unit (AUR ) has made a final determination and is closing their case.

View pageIRS uses Letter 3852C to notify you to explains that you filed a tax return for an LLC, but the return could not be processed.

View page

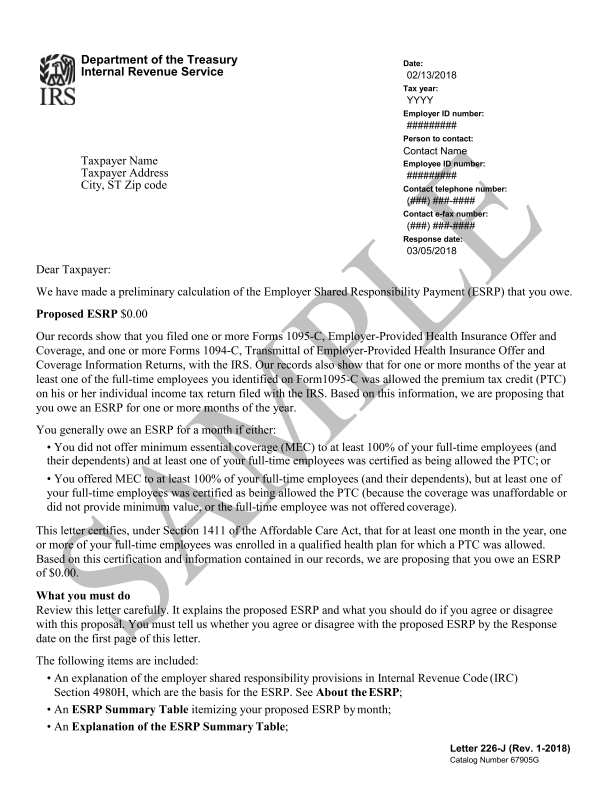

IRS uses Letter 226J to notify you because the IRS compared the information on taxpayer provided Forms 1094-C and 1095-C to the individual income tax returns filed by Company's employees and determined that there is a potential Employer Shared Responsibility Payment (ESRP) liability.

View pageIRS uses Letter 2800C to notify you the IRS believes their employee may have filed an incorrect Form W-4, Employee's Withholding Allowance Certificate.

View pageIRS uses Letter 3711 to notify you to inform you that the IRS has made a worker classification determination for the worker shown on the letter.

View page

IRS uses Letter 1862 to notify the IRS received information from a third-party but did not receive a tax return from the taxpayer.

View page

IRS uses CP216F to notify the request for an extension of time to file an employee plan return (Form 5500 series and/or 8955-SSA). The IRS sent this notice to inform the taxpayer the request was approved.

View pageIRS uses CP216G to notify the request for an extension of time to file an employee plan return (Form 5330). The IRS sent this notice to inform the taxpayer the request was denied because there was no signature on Form 5558.

View page

IRS uses CP216H to notify the request for an extension of time to file an employee plan return. The IRS sent this notice to inform the taxpayer the request was denied because the application was not filed on time.

View pageIRS uses CP85C to notify you because the IRS needs confirmation of the income and expenses reported on Schedule C.

View page

IRS uses CP250 to notify you because their annual federal employment tax filing requirement has changed. You’re no longer eligible to file Form 944, Employer's ANNUAL Federal Tax Return (PDF), to report and pay your employment taxes.

View page

IRS uses CP250C to notify you because their annual federal employment tax filing requirement has changed. You’re no longer eligible to file Form 944, Employer's ANNUAL Federal Tax Return (PDF), to report and pay your employment taxes.

View page

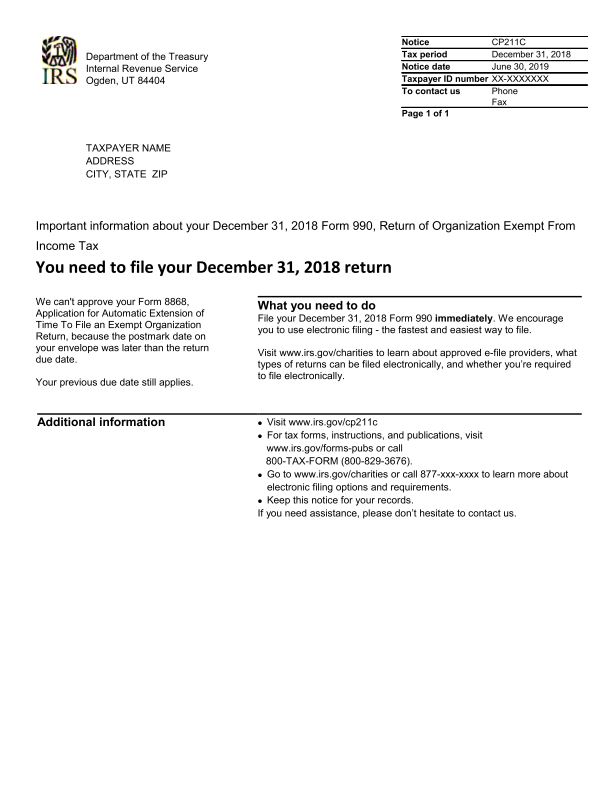

IRS uses CP211C to notify you because the IRS denied your client's Form 8868, Application for Automatic Extension of Time to File an Exempt Organization Return, because it wasn't received on time.

View pageIRS uses Letter 2657 to notify with an updated 4549E to notify taxpayer of the new adjustments made.

View page

IRS uses CP 40 to notify you because your overdue tax account has been assigned to a private collection agency.

View page

IRS uses CP71H to remind you of an unpaid shared responsibility payment on your account. This payment is owed when a taxpayer fails to maintain minimum essential health coverage for themselves or their dependents.

View page

IRS uses CP09 to notify you because they may qualify for the Earned Income Credit (EIC) due to having dependent children but did not claim it on their tax return.

View page

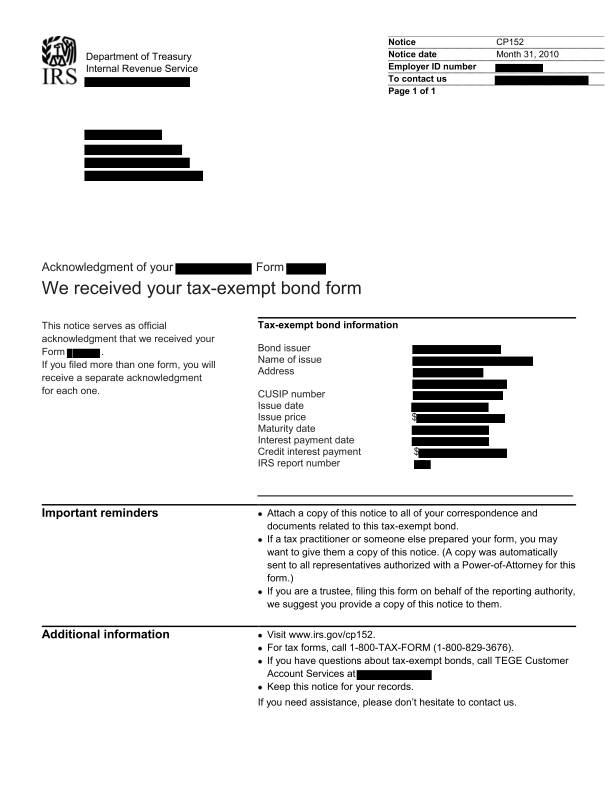

IRS uses CP152 to notify you that you filed a Form 8038 series return for tax exempt bonds. The IRS sent this notice to acknowledge its receipt.

View pageIRS uses CP152 to notify you because the IRS has determined that the Earned Income Credit will not be allowed. This letter explains why the IRS will not allow your earned income credit (EIC).

View page

IRS uses Letter 4883C to notify you because the IRS needs additional information to verify their identity before they can continue to process the tax return. During processing, the IRS determined that the return had a potential for identity theft.

View pageIRS uses LT 4989 to notify you to advise you, the tax preparer, that Form 8867 must be attached to each return claiming Earned Income Tax Credit.

View page

IRS uses CP566 to notify to request additional information regarding taxpayer's application for an individual taxpayer identification number (ITIN).

View page

IRS uses CP259H to notify you because you tax exempt organization has a Form 990/990-EZ filing requirement for the tax year shown. The IRS did not receive Form 990/990-EZ for the year specified.

View pageIRS uses Letter 5821 to notify to instruct you to renew their Individual Taxpayer Identification Number (ITIN) if they will be filing a U.S. tax return.

View page

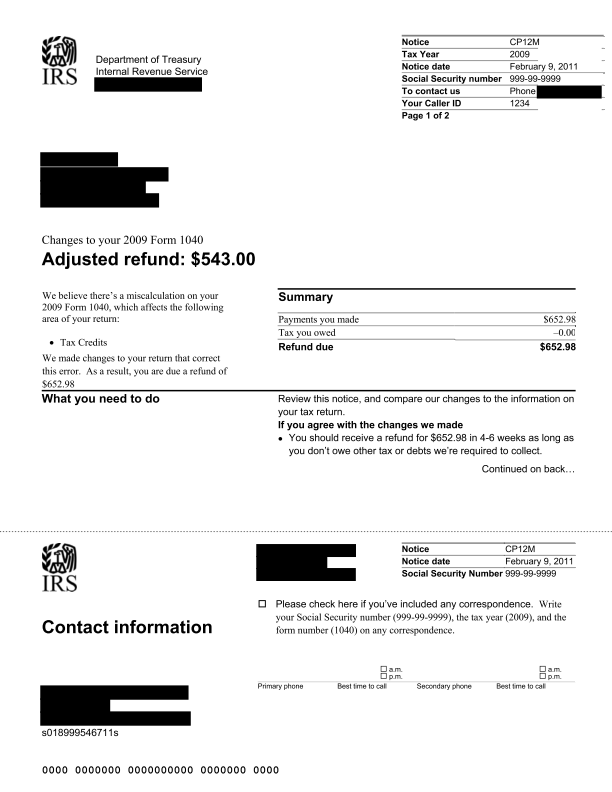

IRS uses CP12M to notify to you that you filed a Form 1040 and claimed the Marking Work Pay credit or the Government Retiree Credit. The IRS made a change in the calculation of the tax credits, resulting in a refund due.

View pageIRS uses CP575A to notify because you either applied for an EIN online, or filed a Form SS-4 to request and EIN.

View pageIRS uses CP575D to notify because you either applied for an EIN online, or filed a Form SS-4 to request and EIN. The IRS sent CP575A to inform the taxpayer of the assigned EIN and to explain the filing requirements based on the business type.

View pageIRS uses CP575C to notify because you either applied for an EIN online, or filed a Form SS-4 to request and EIN. The IRS sent CP575A to inform the taxpayer of the assigned EIN and to explain the filing requirements based on the business type.

View pageIRS uses CP575B to notify because you either applied for an EIN online, or filed a Form SS-4 to request and EIN. The IRS sent CP575B to inform the taxpayer of the assigned EIN and to explain the filing requirements based on the business type.

View pageIRS uses CP262 to notify because you requested a revocation of the S-corporation election. The IRS sent CP262 to notify you the IRS has agreed to revoke the S-corporation election.

View page

IRS uses CP11R to notify because the taxpayer claimed the Recovery Rebate Credit in 2008, and the IRS adjusted the credit because of a calculation error. This adjustment resulted in a balance due for the taxpayer

View page

IRS uses CP12R to notify because the IRS discovered an error in the Recovery Rebate Credit computation on your 2008 return.

View page

IRS uses CP165 to because they have been assessed a penalty for a dishonored ("bad") check sent as a federal tax payment.

View pageIRS uses CP11M to notify you because you filed an original tax return claiming the Making Work Pay credit and/or Government Retiree credit. While processing the return, the IRS encountered a math error computing the credit.

View page

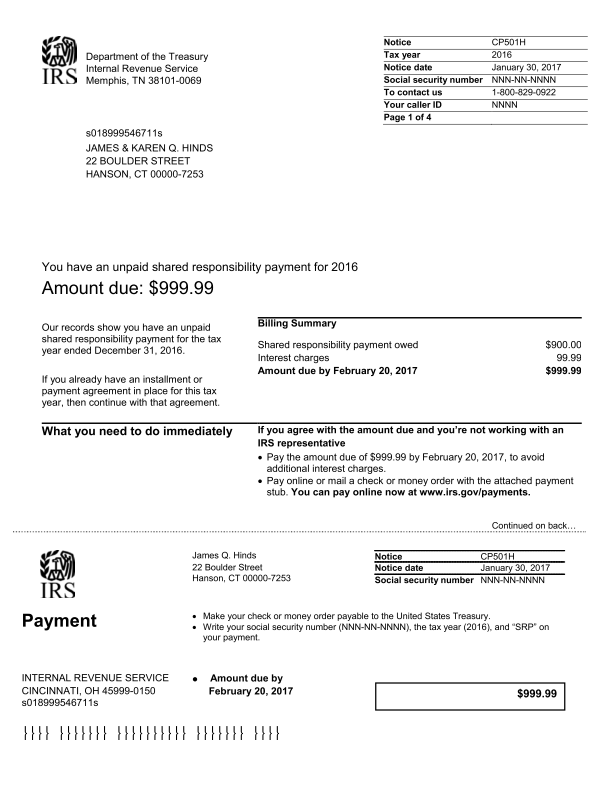

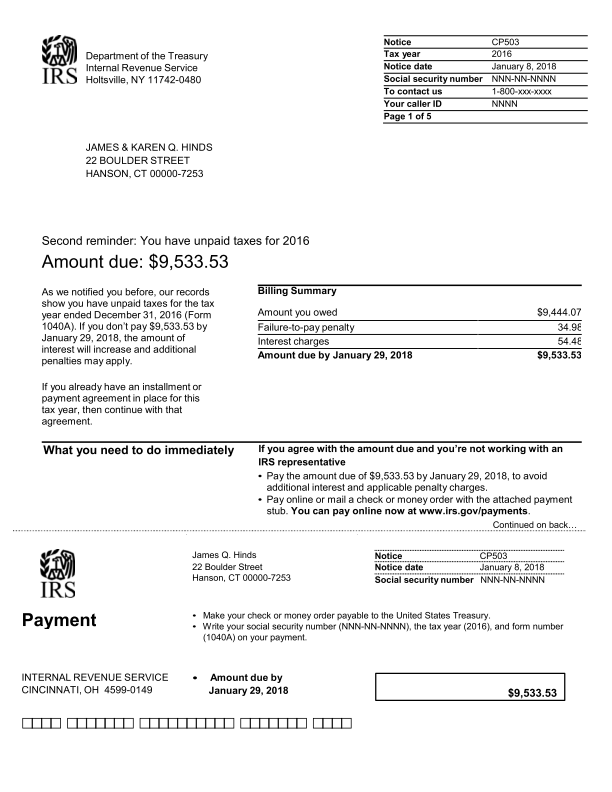

IRS uses CP501H to notify you because the IRS previously sent notice CP14H, CP15H, CP21H or CP22H to inform you of a Shared Responsibility Program (SRP) balance due, but the unpaid balance was not addressed.

View page

IRS uses CP503H to notify you because you have an unpaid shared responsibility payment (SRP) for not having minimum essential health coverage.

View page

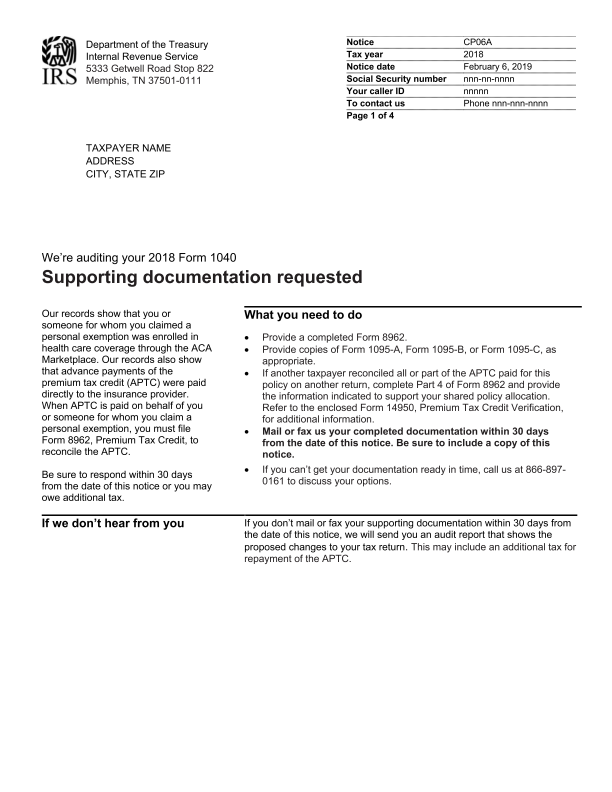

IRS uses CP06 to notify you because you filed a tax return claiming the Premium Tax Credit (PTC) and showing a refund due. The IRS found a discrepancy on the return regarding the PTC and has placed a hold on the refund while this discrepancy is investigated.

View page

IRS uses CP06A to notify you because you filed a tax return claiming the Premium Tax Credit (PTC) and showing a refund due. The IRS found a discrepancy on the return regarding the PTC and has placed a hold on the refund while this discrepancy is investigated.

View page

IRS uses CP08 to notify you because you filed an original return indicating eligibility for the Child Tax Credit however did not take the credit.

View pageIRS uses CP260 to notify you the IRS posted a credit to your account in error. The IRS reversed the credit to correct the error, and you now you have a balance owed.

View pageIRS uses CP85 to notify you that during the processing of your return, the IRS concluded that the taxpayer is not eligible for the Earned Income Tax Credit (EITC) and has disallowed it on the return.

View pageIRS uses CP85B to notify you The IRS believes that one or more of the children you've claimed for the EIC may not be a qualifying child.

View pageIRS uses CP85A to notify you that you claimed Head of Household filing status on the return, and the IRS wants to confirm the filing status.

View pageIRS uses Letter 3050C to notify you that IRS has detected a Math Error or Invalid SSN in the calculation of the Earned Income Credit, Child Tax Credit, Dependent Care Credit, and/or Dependent exemptions.

View page

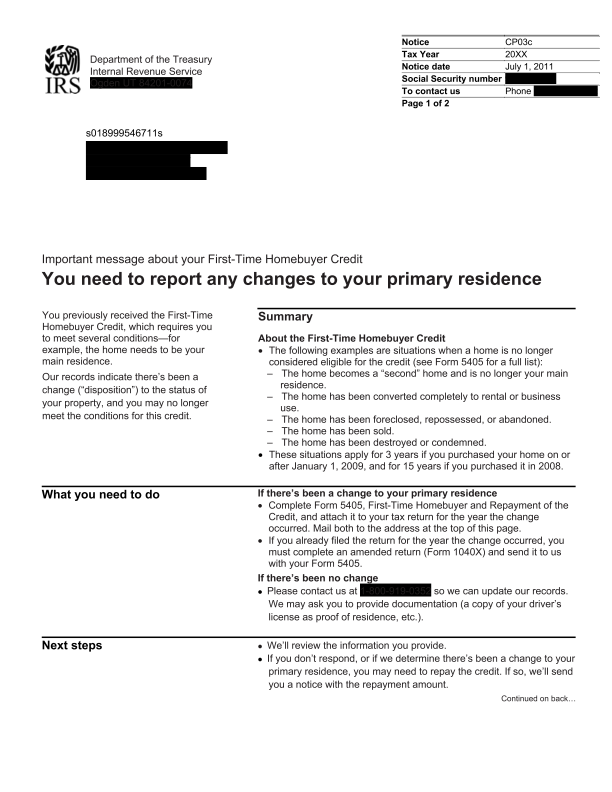

IRS uses CP03C to notify you because you claimed the First-Time Homebuyer credit in 2008, 2009 or 2010, and IRS records (Forms 1099-A, 1099-C, or 1099-S) indicate that the home may no longer be your main residence.

View pageIRS uses Letter 3262 to notify your power of attorney that a Federal Tax Lien (Form 668(Y)(c)) was filed by the IRS against their client.

View pageIRS uses 816C to notify you for several reasons.

View page

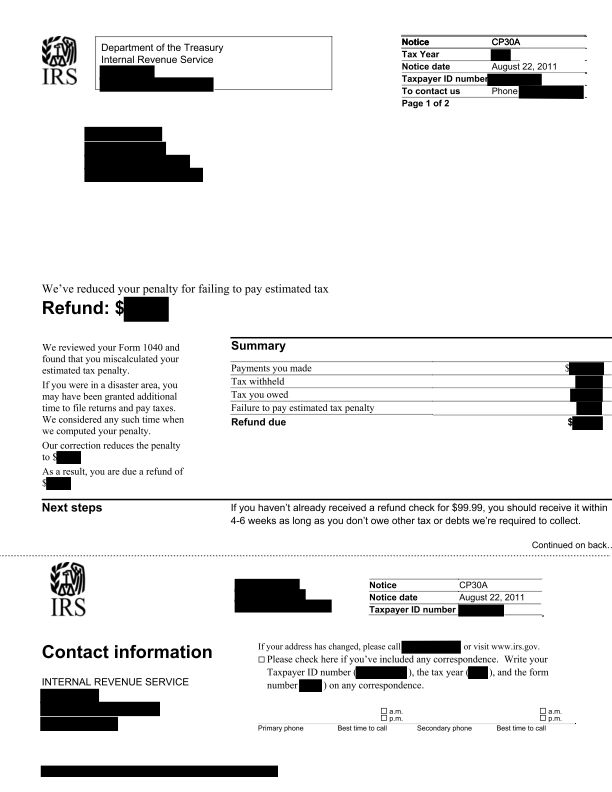

IRS uses CP30A to notify you because the taxpayer penalty for failing to pay estimated tax has been reduced or eliminated.

View page

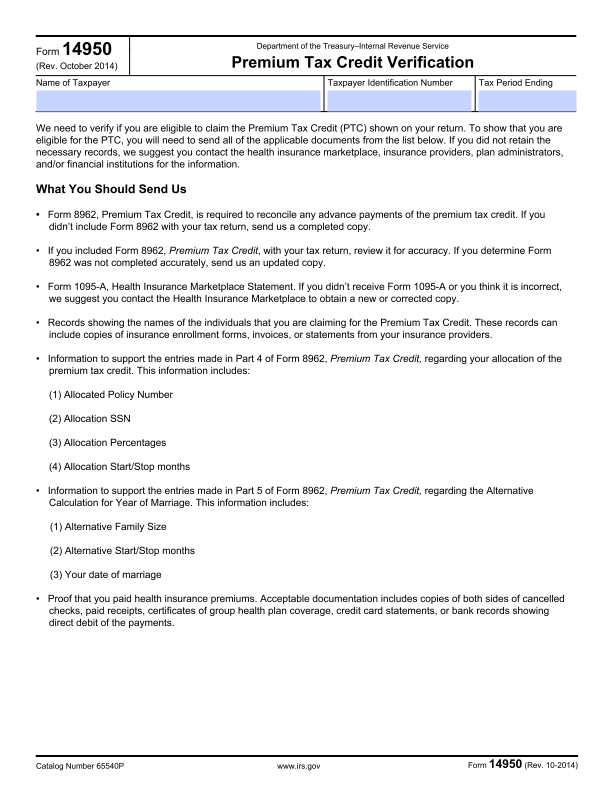

Typically Form 14950 is included as an attachment to notice CP06A or CP06. It is used to verify the premium tax credit claimed on the taxpayer's tax return and will list the requested information that needs to be sent to the IRS.

View pageThe IRS sends letter 4833 to tax preparers it has identified as preparing a large number of returns claiming the EITC and containing errors.

View page

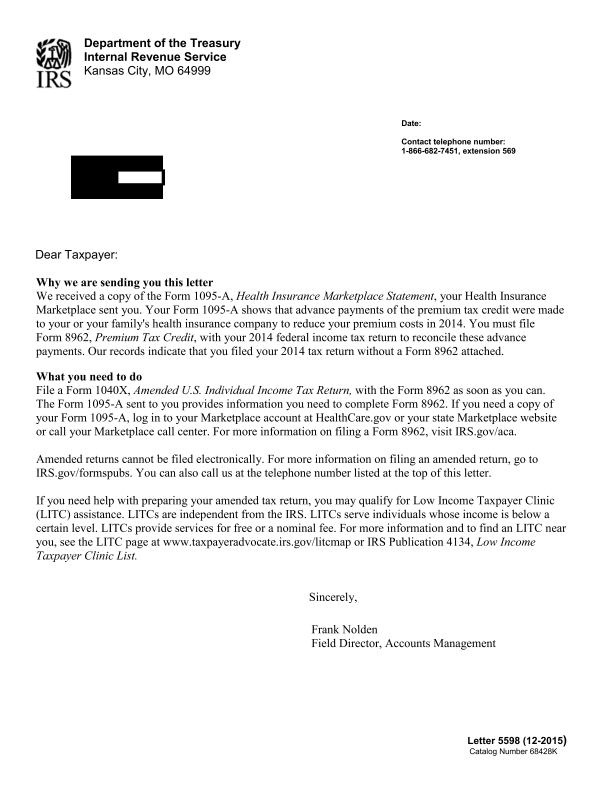

The IRS received a form 1095-A from the health insurance marketplace indicating your client received an advance premium tax credit (PTC).

View page

IRS uses CP21B to notify the changes that you requested have been made to their tax return. As a result, you are due a refund.

View pageIRS uses CP79B to notify because one or more credits (Earned Income Tax Credit, American Opportunity Tax Credit, Child Tax Credit, Additional Child Tax Credit or Credit for Other Dependents) claimed on your tax return were denied and the IRS applied a ten-year ban.

View page

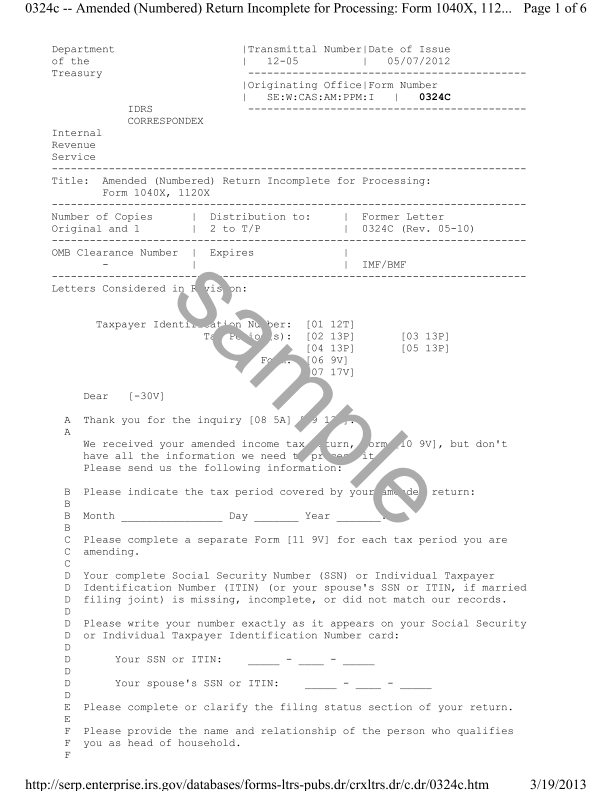

IRS uses Letter 324C to notify because the IRS has received an amended tax return but requires additional information to process it.

View page

IRS uses Letter 5598 to notify because the IRS has received a 1095-A which reported a prepayment of premium tax credit that was not included on the taxpayer's return.

View pageIRS uses Letter 979 to notify because the IRS has audited the return and found that required business records are inadequate.

View pageIRS Notice CP504B is an URGENT notice to inform you the IRS intends to levy against the business assets. It is very similar in effect to the other Notices of Intent to Levy. This notice is URGENT and informs you that in 30 DAYS, short of action on your part, they will take aggressive collect action..

View pageIRS Notice CP504B is an URGENT notice to inform you the IRS intends to levy against the business assets. It is very similar in effect to the other Notices of Intent to Levy. This notice is URGENT and informs you that in 30 DAYS, short of action on your part, they will take aggressive collect action..

View pageThe IRS uses Notice CP 90 (CP90 or IRS CP 90) as a Notice of Intent to Levy to warn you they intend to take your money and assets. This notice is URGENT and informs you that in 30 DAYS, short of action on your part, they will take aggressive collect action.

View pageThe IRS uses Form 668-W(c) (Form 668-W) to notify your employer and you of a levy against your wages. This can be a very difficult situation. If you have unfiled returns, the IRS will not release the levy.

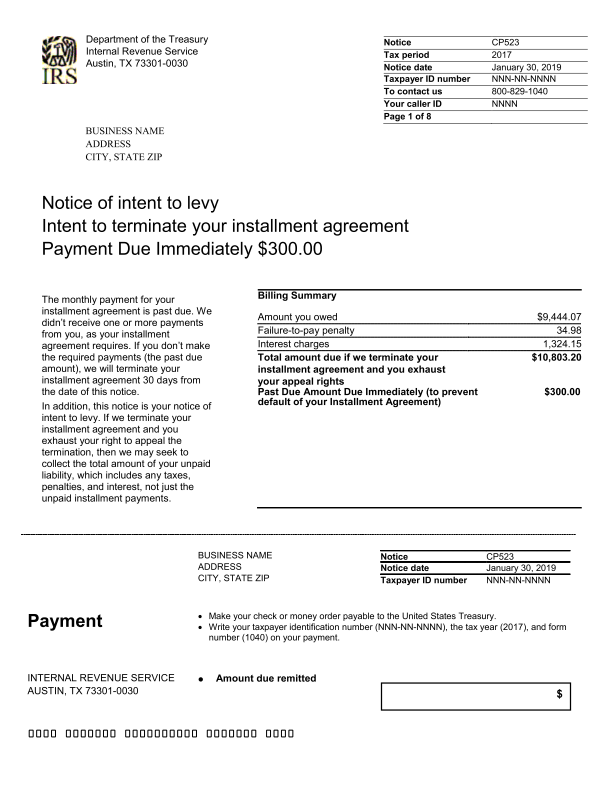

View pageThe IRS uses Notice CP523 to inform you that your installment agreement has defaulted and they intend to levy against your assets. The explanation for why the agreement has defaulted may be vague but it is usually because you missed a payment or owe additional taxes. It could also be because you have unfiled tax returns.

View pageWhen to Use this Form: The Taxpayer Advocate Service (TAS) is your voice at the IRS. TAS may be able to help you if you're experiencing a problem with the IRS and: • Your problem with the IRS is causing financial difficulties for you, your family or your business; • You face (or you business is facing) an immediate threat of adverse action; or • You have tried repeatedly to contact the IRS, but no one has responded, or the IRS has not responded by the date promised. If an IRS office will not give you the help you've asked for or will not help you in time to avoid harm, you may submit this form. The Taxpayer Advocate Service will generally ask the IRS to stop certain activities while your request for assistance is pending (for example, lien filings, levies, and seizures).

View pageForm 433-D is the direct debit authorization form regarding a Direct Debit Installment Agreement.

View pageForm 433-D is the direct debit authorization form regarding a Direct Debit Installment Agreement.

View pageForm 433-D is the direct debit authorization form regarding a Direct Debit Installment Agreement.

View pageForm 433-D is the direct debit authorization form regarding a Direct Debit Installment Agreement.

View pageForm 433-D is the direct debit authorization form regarding a Direct Debit Installment Agreement.

View pageForm 433-D is the direct debit authorization form regarding a Direct Debit Installment Agreement.

View pageThe IRS uses Notice CP 14 (CP14 or IRS CP 14) to inform you of a balance due. Your situation is not yet urgent but should be corrected, soon. The IRS will send gradually more hostile letters until they issue a Notice of Intent to Levy. If you can’t pay the amount quickly, don’t call the IRS or State until you developed a Plan of Action, it will only make matter worse. There only object when they talk to you in this situation is to gather information on how to collect from you.

View pageThe IRS uses Notice CP 14 (CP14 or IRS CP 14) to inform you of a balance due. Your situation is not yet urgent but should be corrected, soon. The IRS will send gradually more hostile letters until they issue a Notice of Intent to Levy. If you can’t pay the amount quickly, don’t call the IRS or State until you developed a Plan of Action, it will only make matter worse. There only object when they talk to you in this situation is to gather information on how to collect from you.

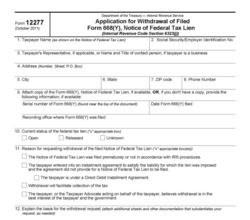

View pageApplication for Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien

View pageApplication for Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien

View pageForm 12153 is used to request a Collection Due Process Hearing with the Internal Revenue Service. If you owe taxes to the Internal Revenue Service, and the IRS issues a Final Notice of Intent to Levy (Letter 1058), files a Notice of Federal Tax Lien or other circumstances exist, you may wish to request a Collection Due Process Hearing.

View pageForm 12153 is used to request a Collection Due Process Hearing with the Internal Revenue Service. If you owe taxes to the Internal Revenue Service, and the IRS issues a Final Notice of Intent to Levy (Letter 1058), files a Notice of Federal Tax Lien or other circumstances exist, you may wish to request a Collection Due Process Hearing.

View pageUse Form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax.

View pageUse Form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax.

View pageThe IRS uses Letter 2205 to inform you of an audit and provides the agent’s name, phone, fax & office address. Letter 2205A is for Individuals. Letter 2205B is for Businesses. The IRS designed Letter 2205-B specifically for S Corporation audits. Because your S Corporation profits and losses are linked to your personal tax return, the IRS will be investigating both your company and you.

View pageUse Form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). Most installment agreements meet our streamlined installment agreement criteria. The maximum term for a streamlined agreement is 72 months. In certain circumstances, you can have longer to pay or your agreement can be approved for an amount that is less than the amount of tax you owe. However, before requesting an installment agreement, you should consider other less costly alternatives, such as getting a bank loan or using available credit on a credit card.

View pageIRS uses Letter 226J to notify you because the IRS believes their employee may have filed an incorrect Form W-4, Employee's Withholding Allowance Certificate.

View pageIRS uses Letter 226J to notify you because the IRS believes their employee may have filed an incorrect Form W-4, Employee's Withholding Allowance Certificate.

View pageWhere to Mail Form 8379 | Where do I Send Form 8379

View pageIRS Form 8379 Online | IRS Form 8379 Mailing Address

View pageIRS Injured Spouse Form 8379 | File Form 8379 Electronically

View pageWhere to Mail Form 8379 IRS

View pageThe IRS uses Form 4564 to request information from you in an audit.

View pageThe IRS uses Letter 1153 (IRS Letter 1153, LTR 1153, Notice 1153) to propose an assessment of the Trust Fund Recovery Penalty against a Responsible Party.

View page

If you are a student who pays for your own education, or you are a guardian claiming a student as a dependent, you can expect to receive Form 1098-T.

View pagen early March 2020, the IRS released Rev. Proc. 2020-17 which provides an exemption from the information reporting requirements under IRC § 6048 – specifically, the filing of Forms 3520 and 3520-A. In addition, it provides tax relief for taxpayers who’ve been assessed penalties under IRC § 6677 for failure to file these forms.

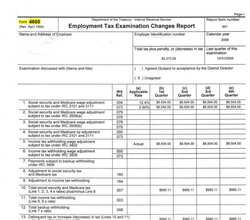

View pagehe IRS uses Form 4549-A to reports its audit findings. They also can use Form 4549 or Form 4549-E.

View page